U.S. Equities Hit Record Highs on Earnings Growth and AI Momentum

U.S. equity markets have surged to new record highs, with the S&P 500, Dow Jones Industrial Average, and Nasdaq 100 all setting record highs. Since July 1, the S&P 500 has gained 8.25%, the Dow is up 6.6%, and the Nasdaq 100 has rallied 14.6%. Year to date to today, the S&P 500 is up over 15%, Nasdaq over 20% and Dow Jones almost 11%.The advance reflects broad-based investor optimism supported by strong corporate earnings, resilient consumer spending, and growing expectations that the Federal Reserve will begin cutting interest rates before year-end.

Momentum has been sustained by a powerful combination of robust fundamentals, improving sentiment and easing tariff concerns. The ongoing wave of AI-related capital investment has reinforced growth prospects across the technology, industrial, and communications sectors, while household consumption remains surprisingly strong despite elevated borrowing costs. Corporate profits have consistently exceeded expectations, and optimism over prospective monetary easing—investors currently anticipate up to three rate cuts by the US Federal Reserve—has further buoyed equity valuations and risk appetite. Altogether, these forces have underpinned a powerful rally that has allowed markets to look past lingering concerns about high valuations, a softening labour market, and geopolitical uncertainty.

Trade Uncertainty Persists Ahead of APEC

While markets have largely looked past disruptions such as the U.S. federal government shutdown and unresolved trade negotiations, uncertainty surrounding tariffs continues to cloud the outlook. Talks with China, Canada, and Mexico remain unsettled, leaving investors cautious about the potential effects on cross-border supply chains and business investment.

Trade tensions with Canada, in particular, have intensified following the Ontario government’s distribution of a “Regan tariff” commercial, which reignited debate over U.S.–Canada trade fairness. This dispute adds a new dimension to an already fragile trade environment and comes as both sides weigh potential retaliatory measures. The upcoming APEC Summit in South Korea at the end of October could provide the first clear signals of progress—or further escalation—on global trade talks involving the U.S., China, and key Asian partners. Until then, uncertainty over tariffs and supply-chain costs continues to weigh on manufacturing sentiment and forward corporate investment plans.

Growth Resilient Despite Data Disruptions

Despite the ongoing U.S. government shutdown, which has delayed several key economic releases, available indicators suggest underlying strength in activity. The Atlanta Fed’s GDPNow model estimates 3.9% annualized growth for Q4, though confidence around that projection is lower given limited data availability.

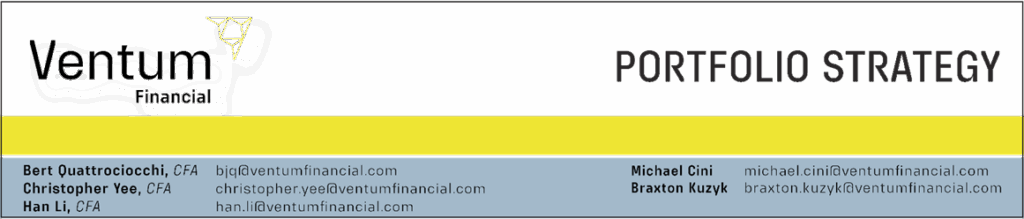

Private surveys indicate that labor-market momentum has softened: the employment components of both the ISM manufacturing and services PMIs have slipped into contraction territory, implying cooling job creation. Nevertheless, forward inflation expectations have eased, and broader economic growth appears intact even amid fiscal disruptions.

Inflation Outlook – Mixed Signals but Broadly Contained

The latest CPI report showed headline inflation ticking higher while core inflation eased to 3.0%, reflecting a more muted price backdrop. Goods inflation is re-accelerating in tariff-sensitive categories such as apparel (+0.7%), furnishings (+0.4%), and household appliances, yet easing housing inflation—a key component with heavy CPI weighting—has helped anchor the overall trend, with Owners’ Equivalent Rent rising only 0.14% and primary rents up 0.20%, their weakest readings since 2020.

Taken together, inflation remains under control in market expectations, with breakeven rates and futures pricing pointing to stability. However, persistent policy uncertainty has eroded consumer confidence, even as actual spending data show no material slowdown in household demand. The University of Michigan consumer sentiment index recently registered 53.6, just over one point above the April–May low of 52.2, underscoring a still-fragile mood among U.S. households.

U.S. Policy Expectations – Markets See More Easing Ahead

The US Federal Reserve delivered its first rate cut of the year in September 2025, lowering the target range to 4.00–4.25%. The U.S. 10-year Treasury yield has since eased from around 4.25% at the start of the second half of 2025 to approximately 4.0% as of October 24, reflecting growing confidence that inflation is under control despite the threat from tariffs. Markets now anticipate two additional rate cuts by year-end, as implied by Fed funds futures, while prediction markets such as Polymarket are even more dovish—assigning an 80% probability to three total cuts before the end of 2025.

This emerging consensus for further easing underscores a delicate policy balance: moderating inflation, softening labor-market conditions, and a central bank intent on preventing an unnecessary slowdown while maintaining its commitment to price stability.

U.S. Corporate Earnings – Strength Across Sectors

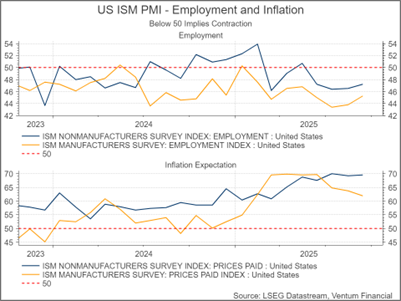

Earnings estimates for FY 2025–2027 have climbed back to levels seen near the April “Liberation Day” rally, highlighting confidence in corporate profitability despite macro headwinds. Corporate America continues to deliver robust earnings momentum. As of October 24, roughly 29% of S&P 500 constituents have reported Q3 results, with 87% surpassing consensus estimates—one of the strongest beat rates in recent cycles.

Financials have led the way: 36 of 39 firms in the sector have reported, with 94% exceeding analyst earnings forecasts. Industrials followed closely, with 90% of companies beating estimates, underscoring healthy demand across logistics, manufacturing, and capital-goods segments. In Information Technology, 85% of reporters have topped expectations so far, though only 13 of 55 firms have released results; the upcoming reports from major tech platforms will be closely watched for confirmation of the sector’s strength.

Canadian Markets Show Resilience as Labour Softens and Consumption Holds

Despite signs of labour-market strain, Canadian economic activity continues to show pockets of strength. While the national unemployment rate has climbed to 7.1%, retail sales remain robust, rising 4.9% year over year in August—illustrating a bifurcated picture of a softening jobs market yet resilient household demand. According to the Bank of Canada’s July 2025 Monetary Policy Report, real GDP is expected to bottom in the third quarter of 2025, following modest contractions earlier in the year, and to return to growth of roughly 1% in the second half. The rebound is projected to be supported by fiscal stimulus, easing financial conditions, and improving trade clarity as global supply disruptions and tariff uncertainties begin to stabilize.

Labour Market – Weakening Momentum

In August, the Canadian jobless rate rose to 7.1%, up from 6.9% in July, marking a return to levels not seen since the last business-cycle trough. Employment contracted by approximately 65,500 positions, driven largely by losses in part-time work and weaker hiring momentum across services and transportation sectors. While the labour-force participation rate dipped slightly, the combination of job losses and rising unemployment suggests that growth is encountering headwinds. Notably, the softening labour market has disproportionately affected young workers and new graduates—a trend some economists attribute to the increasing adoption of AI and automation, which may be displacing certain entry-level roles.

Consumer Spending – A Bright Spot

On the consumer front, retail activity continues to support the economy. Retail sales in August increased by 1.0% month-on-month to C$70.4 billion, and rose 4.9% year-on-year, according to Statistics Canada. When excluding volatile sectors such as autos and fuel, sales advanced 4.5% year-on-year and strengthened 0.7% month-on-month. That spending resilience provides a counterweight to weak employment and supports the outlook for growth over the near term.

Canadian Policy Rate Outlook

The latest inflation report came in slightly hotter than anticipated, as the prior month’s decline in energy prices exerted a smaller disinflationary effect on headline CPI. Year-over-year comparisons were also influenced by a sharp drop in energy prices last September, which has temporarily lifted the annual headline measure above expectations. Nonetheless, the broader inflation picture remains contained. The Canadian 10-year government bond yield has eased from around 3.25% at the start of the second half of 2025 to just above 3.0% as of October 24, reflecting investor confidence that price pressures are moderating. The Bank of Canada is now expected to deliver one additional rate cut before holding steady for an extended period, as policymakers balance a softening labour market with still-firm consumer demand.

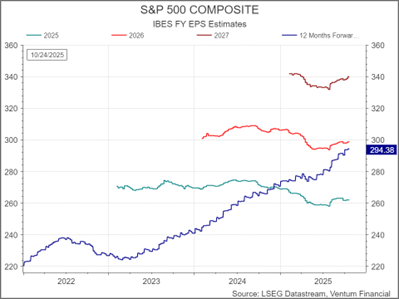

Canadian Corporate Earnings – Revisions Turning Positive

Corporate earnings momentum in Canada has continued to improve through the second half of 2025, reflecting steady domestic demand and firm commodity prices. As of October 24th, eight of the eleven S&P/TSX sectors have seen upward revisions to both revenue and earnings forecasts on a three-month moving-average basis. The strongest earnings revisions have come from Health Care (+13.5%), Materials (+12.4%), and Financials (+8.0%), supported by resilient gold prices, stabilizing credit conditions, and renewed strength in capital markets activity. Information Technology (+4.6%) and Utilities (+4.4%) have also trended higher, benefitting from ongoing digital investment and defensive inflows. In contrast, Energy (-3.1%), Industrials (-7.0%), and Communication Services (-3.9%) continue to face downward revisions amid export uncertainty and weaker capital spending. Overall, analyst sentiment toward Canadian corporates has turned decisively positive, with earnings estimates for FY2025 and FY2026 now back to levels last seen at the start of the year—reinforcing that confidence is rebuilding despite trade frictions and a softening labour backdrop.

Equity Markets Summary

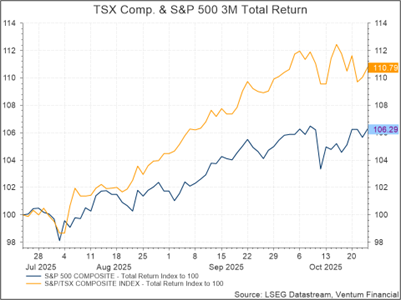

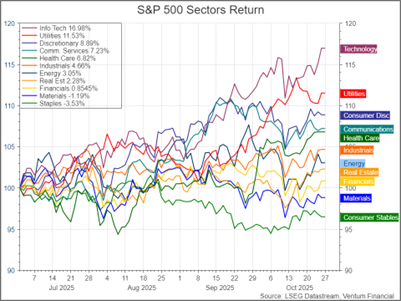

North American equities delivered strong gains over the past three months, supported by moderating inflation, renewed rate-cut expectations, and continued enthusiasm around AI and commodity-linked sectors.

In Canada, the S&P/TSX Composite Index rose 10.8% for the three months ended October 24, 2025, led by a powerful rebound in gold and silver prices, which climbed 20% and 25%, respectively. With Materials representing about 16% of the index, this surge provided a substantial lift to overall returns. The strongest sectors were Materials (+28.5%), Technology (+20.3%), and Health Care (+13.4%), while Consumer Staples (+0.0%), Industrials (+0.6%), and Telecoms (+2.8%) lagged. We note that performance in Health Care and Telecoms—both small, concentrated sectors in Canada—was largely driven by company-specific moves rather than broad industry trends.

In the United States, the S&P 500 gained 6.0% and the Nasdaq Composite rose 8.8% over the same period. Market strength remained concentrated in AI-related names, with Micron, Western Digital, Intel, AMD, and Lam Research among the top contributors. Communication Services (+11.4%), Technology (+10.9%), and Health Care (+7.2%) led sector performance, while Materials (-2.1%), Financials (-1.0%), and Consumer Staples (-0.7%) trailed.

While both markets posted strong absolute gains, Canada’s performance was more materials-driven, with precious metals—particularly gold— leading gains. Year to date, the S&P TSX Composite has outpaced US benchmarks with a price return of 22.75% vs 15.47%.

Despite these headwinds, earnings have generally exceeded expectations, especially among companies tied to AI infrastructure, cloud computing, and defense and industrial modernization. Out of the 143 S&P 500 companies who have reported their Q3 results to date, 87% have reported earnings above expectations. Governments continue to signal support for domestic manufacturing and infrastructure investment, which should benefit select industrials, utilities, and defense-related sectors. With policy tailwinds, moderating inflation, and robust household balance sheets, the fundamental backdrop for equities remains supportive even as valuation dispersion increases.

Portfolio Strategy and Outlook

Our near- to medium-term outlook for equities and bonds remains constructive however we more cautious given the unresolved US trade negotiations with Canada and China.

Given easing inflation, lower energy prices and softer job’s market we are expecting the US Fed and Bank of Canada to lower their benchmark rates 25 basis points next week and in December which should be a tailwind for bond and equity prices.

We suggest a slightly higher cash/bond weighting given the recent gains and elevated valuations and continue to favour high-quality growth companies with durable margins, strong balance sheets, and pricing power. Recall, lower quality/higher risk companies tend to sell off more during market corrections.

We continue to like the technology sector and those benefiting from AI. Key areas of focus include semiconductor, networking, electrical, hyperscalers, industrials serving datacenters and select utilities positioned to benefit from ongoing macro trends. In Canada, we like companies poised to gain from the anticipated wave of capital expenditure, while reducing exposure to materials following the sharp rise in gold and silver prices.

We caution that the current AI-driven enthusiasm has significantly elevated technology company valuations and that the U.S. market is highly concentrated in the technology sector, with the top seven technology firms now accounting for roughly 30% of the S&P 500’s total market capitalization. This AI capex spend is huge. Some estimates suggest that U.S. capital spending on AI and data-center infrastructure could reach 2% of GDP in 2025, with global investment potentially climbing into the trillions by 2030. Against this backdrop, there is little room for disappointment and thus we expect volatility to remain elevated through year-end and continue to recommend a selective, disciplined approach to risk-taking.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies.

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 – 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.