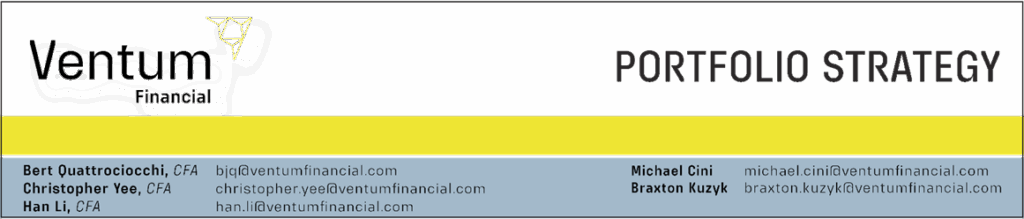

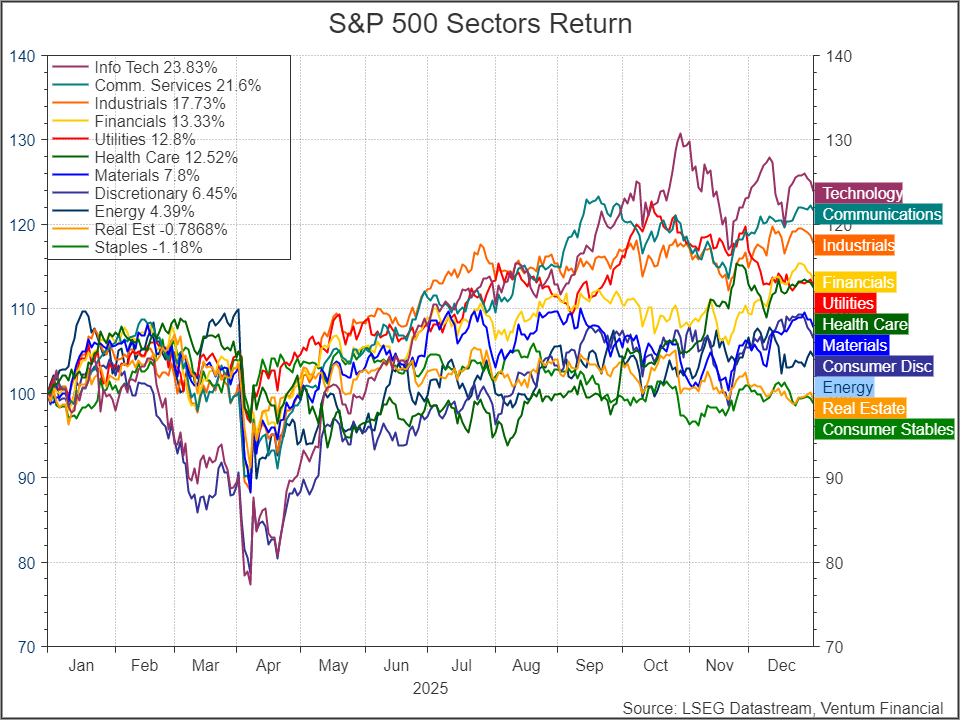

What began as one of the most unnerving starts to a year in recent memory—marked by an early-year drawdown approaching 20%—ended in a powerful and unexpected rally. From the April lows, the reversal in equities was truly remarkable, and instead of sliding into recession as many feared, the S&P 500 finished 2025 up 16.4%.

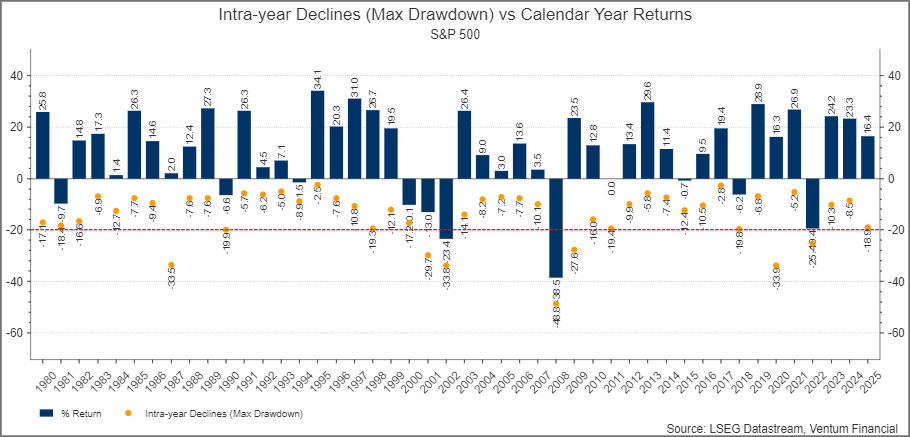

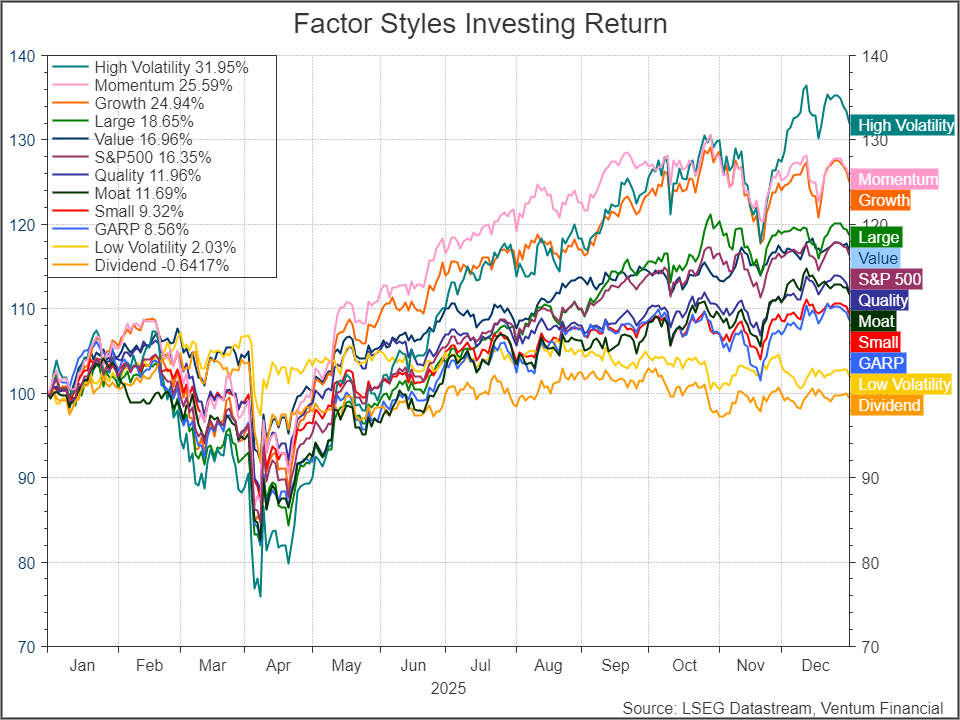

Performance was led by strong gains in Growth (+24.9%), Momentum (+25.6%), and High Volatility (+32.0%), while more defensive factor styles materially lagged. Low Volatility (+2.0%) and Dividend (-0.6%) strategies underperformed, underscoring a market environment that rewarded risk-taking, earnings leverage, and exposure to secular growth rather than capital preservation.

This outcome unfolded against a policy backdrop that proved far more supportive than sentiment had initially implied. While fears of a renewed Trump trade war weighed heavily on confidence early in the year, the actual implementation was far more moderate than expected, significantly reducing downside risks to global growth. Depressed sentiment itself became a catalyst for action, prompting aggressive fiscal and monetary stimulus across major economies worldwide. In the U.S., sustained government spending on infrastructure, aerospace, energy transition, and AI investment coincided with a monetary environment that, although restrictive in headline terms, eased meaningfully as financial conditions improved and markets priced in future rate cuts.

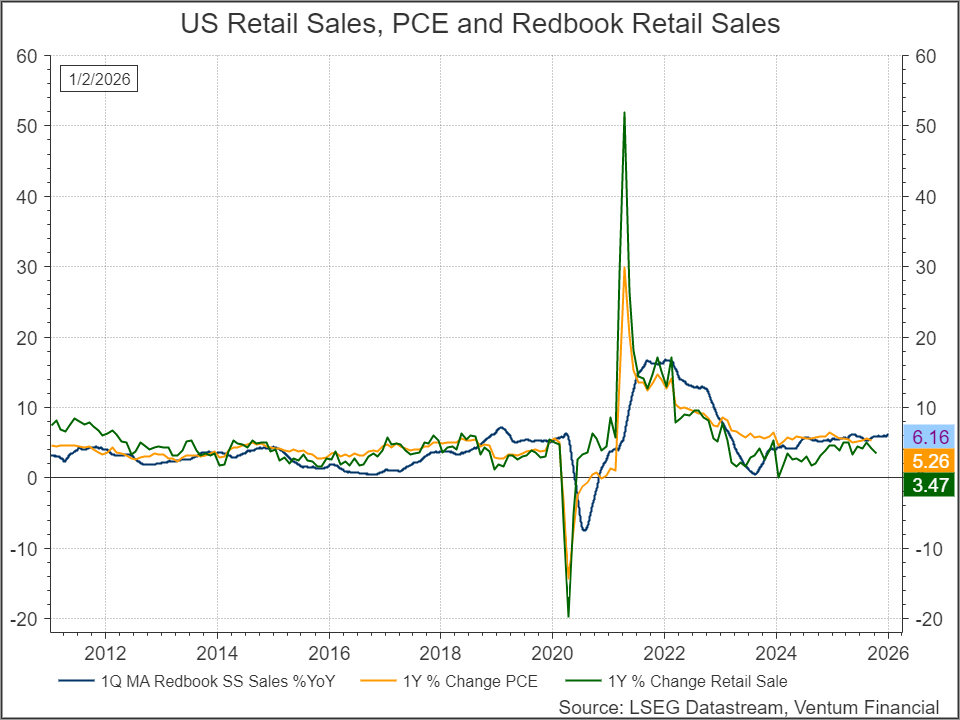

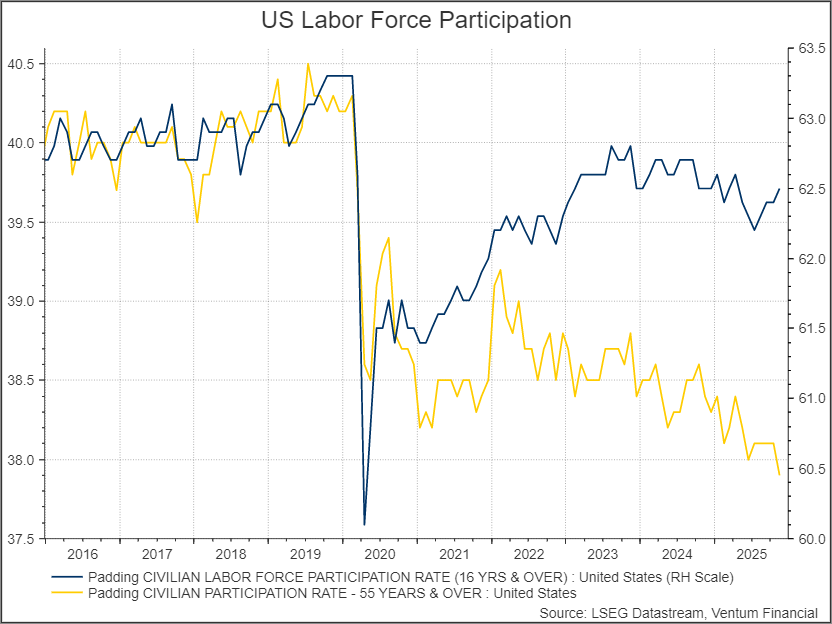

At the same time, labor-market indicators continued to soften. Job creation slowed, participation rates remained structurally lower than pre-pandemic levels, and hiring breadth narrowed. Yet this weakening did not translate into a material slowdown in consumption.

Rising equity markets generated a powerful wealth effect, particularly for higher-income households with significant financial asset exposure. In addition, a structurally larger cohort of early retirees—largely insulated from labor-market conditions and increasingly dependent on investment income—continued to support consumer spending, helping stabilize aggregate demand despite softer employment trends.

Market leadership remained narrow throughout the year. Growth- and momentum-heavy sectors such as Information Technology (+23.8%) and Communication Services (+21.6%) led returns, while Industrials (+17.7%) benefited from data center construction, grid electrification, and defense-related spending. Utilities (+12.8%) also outperformed, driven by surging power demand from AI infrastructure. In contrast, defensive and diversified exposures—including Quality (+12.0%), Value (+17.0%), and GARP (+8.6%)—posted only modest gains, reinforcing the lack of broad market participation.

In the Invesco S&P 500 High Beta ETF, which we use as a proxy for the high volatility factor, technology stocks account for nearly half of portfolio weight at 44.5%. By comparison, technology represents 58.27% of the Invesco S&P 500 Growth ETF and exactly 50% of the Invesco Momentum ETF. The strong outperformance of Information Technology and Communication Services was a key driver behind these factor styles reaching new all-time highs over the year.

Within the technology sector, several semiconductor and storage companies posted exceptional gains, including Micron (+240%), Western Digital (+283%), and Seagate Technology (+225%), all benefiting from the sustained AI-related capital expenditure cycle, particularly in data-center infrastructure and memory demand.

Communication Services also contributed meaningfully to performance. Warner Bros. Discovery (+172%) surged amid reports of a potential acquisition, as Netflix and Paramount were rumored to be engaged in a bidding war for the company. Alphabet (Google) ended the year up +66%, driven by strong execution and market reception of its Gemini AI model, making it the best-performing stock among the mega-cap cohort.

Performance strength extended beyond technology into Industrials. Large-cap industrial names such as GE Aerospace (+85%) and GE Vernova (+99%) finished the year among the top performers, supported by robust demand for aerospace equipment and power-generation solutions. Caterpillar also delivered solid gains of approximately 60%, reflecting investor optimism around rising electricity demand tied to ongoing data-center expansion.

The Bigger Picture

Taken together, 2025 was defined less by traditional cyclical strength and more by policy-enabled resilience and surging AI/technology capex spending. Fiscal spending and easier financial conditions sustained asset prices, which in turn supported consumption—even as labor market fundamentals softened. The result was a market that rewarded growth, momentum, and volatility, while offering limited compensation for quality and defensiveness.

This dynamic underscores a key risk going forward: if policy support fades, higher interest rates or asset prices stall, consumption may prove more vulnerable than headline data currently suggest. For now, however, markets continue to price a world where liquidity, not labor, is the dominant driver of economic outcomes.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies.

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 – 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.