US Fed Cuts on Jobs Weakness as Growth and Yields Signal Strength

The second half of 2025 has brought clearer signs of labor-market strain. August saw only 22,000 new US payrolls — a sharp slowdown from prior months, and well below consensus expectations. At the same time, the Bureau of Labor Statistics made a dramatic downward revision to its 2024–2025 employment estimates: the U.S. added 911,000 fewer jobs over that period than initially reported, making it one of the largest benchmark corrections in recent memory. Some earlier months were revised sharply downward (for instance, June was revised to a net loss of ~13,000 jobs).

These developments raised growing concerns that employers were pulling back on hiring amid softening demand, and that the momentum in the labor market was losing steam — even before inflation concerns had fully receded.

Against this backdrop, the US Federal Reserve delivered a 25 basis-point cut to its policy rate on September 15 (bringing the target range to 4.00%–4.25%) — its first cut of 2025 — explicitly citing labor‐market risks as a key factor in the decision. Fed Chair Powell acknowledged that near-term downside risks to employment had grown, shifting the policy calculus toward easing even in a still-elevated inflation environment.

Despite fears of labor-market cooling, the broader U.S. economy continues to demonstrate resilience. The Atlanta Fed’s GDPNow model pegs Q3 real GDP growth at an annualized 3.9% as of September 26, while Q2 growth was revised up to 3.8% from 3.3%. Even following the Fed’s September 15 rate cut, the U.S. 10-year Treasury yield climbed nearly 20 basis points, briefly touching 4.20% in the two weeks that followed — a signal of investor confidence in the durability of growth.

US Inflation pressures, by contrast, remain contained. Headline PCE ticked up to 2.7% from 2.6% the prior month, but the move was broadly in line with expectations. Importantly, shelter components such as housing and rents — among the heaviest weights in both CPI and PCE — have been trending lower since the beginning of the year, helping offset tariff-related price pressures.

US Consumer spending has also proven robust, particularly in discretionary categories. Travel and leisure demand has remained firm, with recreation services rising 1.5% month over month and 2.5% year over year, while food services and accommodation posted a 2.5% annual increase in the latest September release. Taken together, these dynamics paint a picture of an economy that remains remarkably resilient, balancing softer labor data with solid growth, stable inflation, and strong consumer demand.

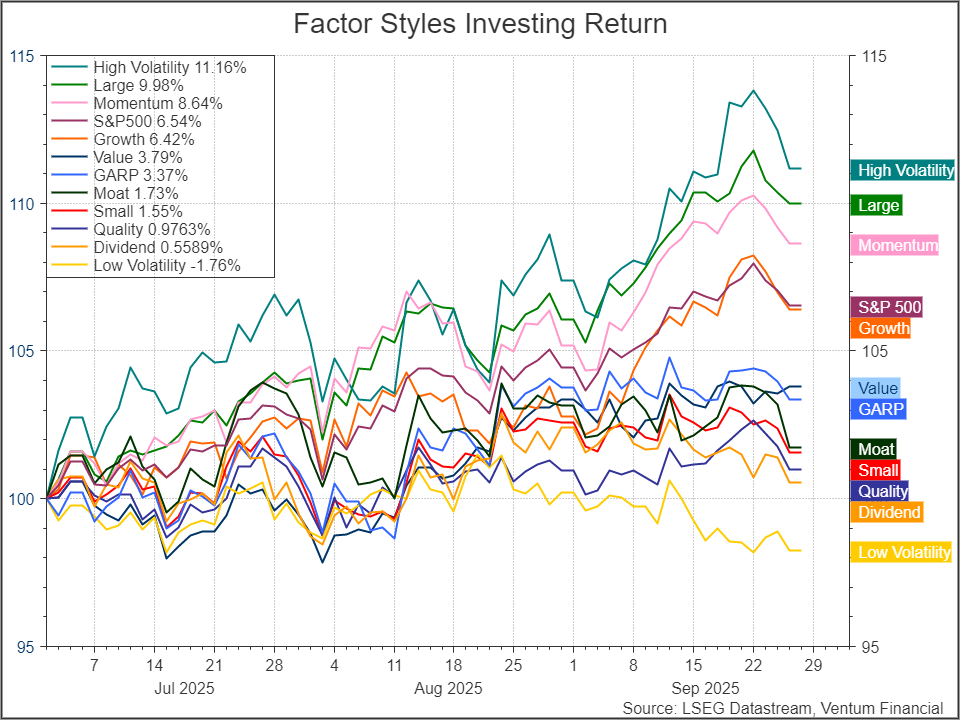

Since the start of July, factor performance has tilted decisively toward risk-on and growth-driven exposures. High Volatility has led all styles with a strong +11.2% return, closely followed by Large Cap (+10.0%) and Momentum (+8.6%). Growth (+6.4%) and Value (+3.8%) also advanced, while the broad S&P 500 posted a more moderate (+6.5%). In contrast, defensive and income-oriented strategies have struggled: Quality (+1.0%) and Dividend (+0.6%) barely kept pace, and Low Volatility slid into negative territory (-1.8%), underlining investors’ preference for high-beta leadership.

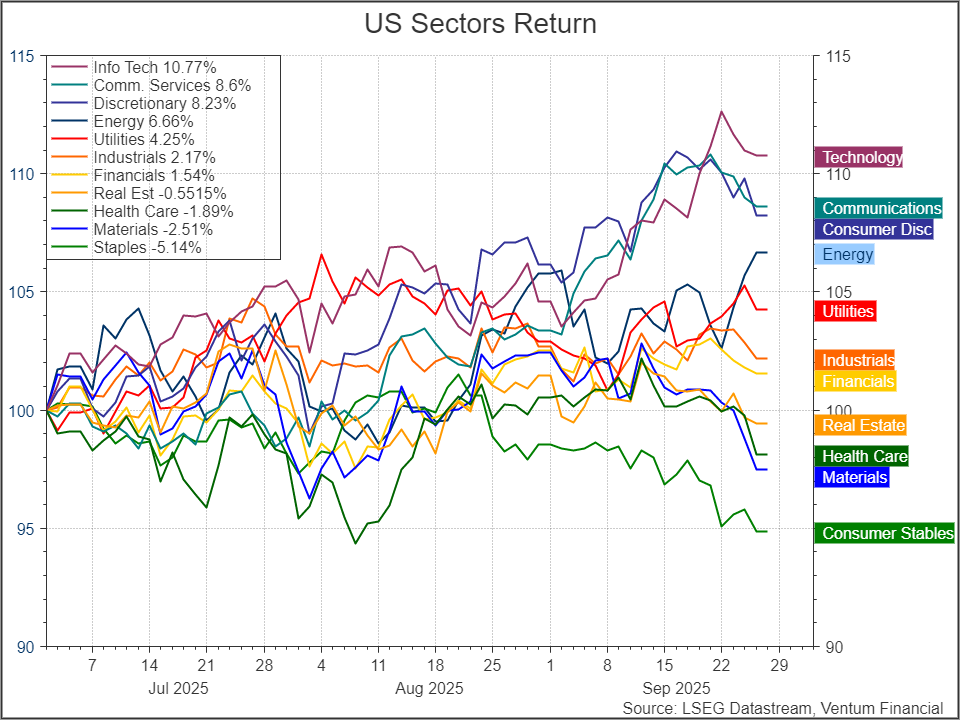

Sector leadership has been similarly concentrated. Information Technology (+10.8%), Communication Services (+8.6%), and Consumer Discretionary (+8.2%) drove the market higher, reflecting continued enthusiasm for AI, digital platforms, and resilient consumer demand. Energy (+6.7%) provided cyclical support amid firmer commodity pricing, while Utilities (+4.3%) gained modestly. In contrast, traditionally defensive groups underperformed sharply: Consumer Staples (-5.1%), Materials (-2.5%), and Health Care (-1.9%) all lost ground, while Real Estate (-0.6%) and Financials (+1.5%) lagged. Industrials (+2.2%) posted small gains but fell well short of their February highs.

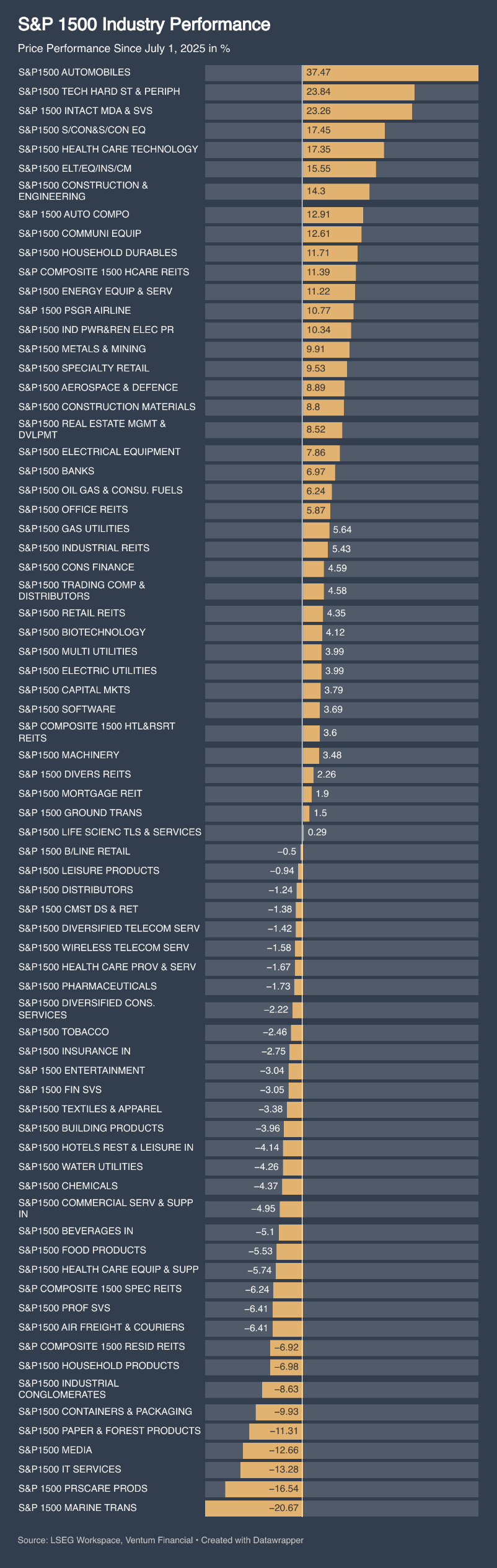

At the industry level, performance since July 1 has been highly uneven. Automobiles have been the standout, surging +37.4% on the back of Tesla’s strong rebound. Technology hardware and semiconductor names also delivered robust gains, reflecting the ongoing strength of the AI trade. Yet not all industries tied to technology have benefited: IT Services, which includes firms such as Accenture, slumped -13.2% amid growing concerns that AI could disrupt traditional consulting models.

Trade-exposed groups have been among the hardest hit by tariffs. Marine Transportation is the weakest performer (-20.6%), while Personal Care Products (-16.5%) and Containers & Packaging (-9.9%) also suffered, reflecting pressures on goods-related supply chains. Paper & Forest Products (-11.3%) similarly underperformed, weighed down by elevated interest rates and muted housing activity.

The dispersion underscores the nuance in the current rally — while select industries leveraged to AI, electrification, and consumer resilience are powering ahead, others more exposed to trade frictions, interest-rate sensitivity, or structural shifts in technology are being left behind.

Source: LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies.

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 – 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.