Canadian Equities Defy Trade War Pressures

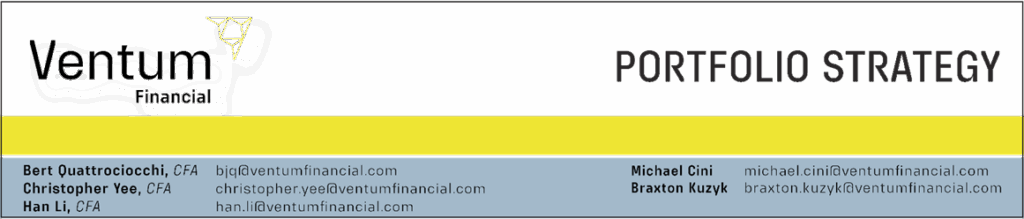

Despite renewed trade tensions with the U.S. under the Trump administration, the S&P/TSX Composite Index has surged more than 21% year to date, underscoring the market’s resilience amid a challenging macro backdrop. While employment has softened — with the jobless rate rising to 7.1% in June — household consumption has held up better than expected, supported by steady wage growth and limited layoffs. July’s retail sales data point to year-over-year growth exceeding 4%, reflecting sustained consumer momentum. Gold has been a key driver of the rally, with the S&P/TSX materials sector posting gains of more than 80% year to date.

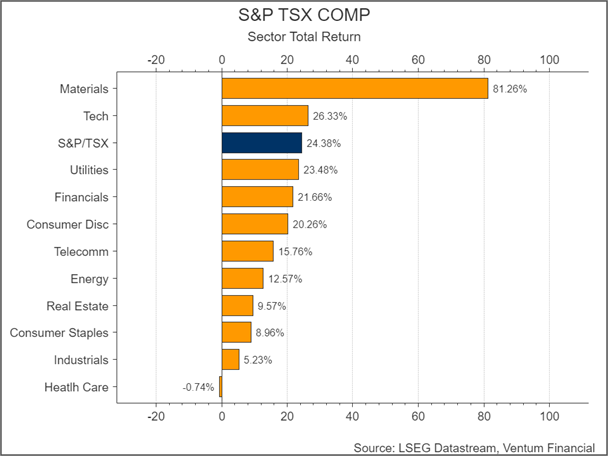

On the corporate earnings front, eight of the eleven sectors have seen improvement since August, when President Trump extended the tariff détente with China for another 90 days. Notably, earnings estimates for the S&P/TSX in FY2025 and FY2026 have recovered to levels last seen at the start of the year, suggesting improving corporate confidence even as the broader economy remains weighed down by ongoing trade frictions.

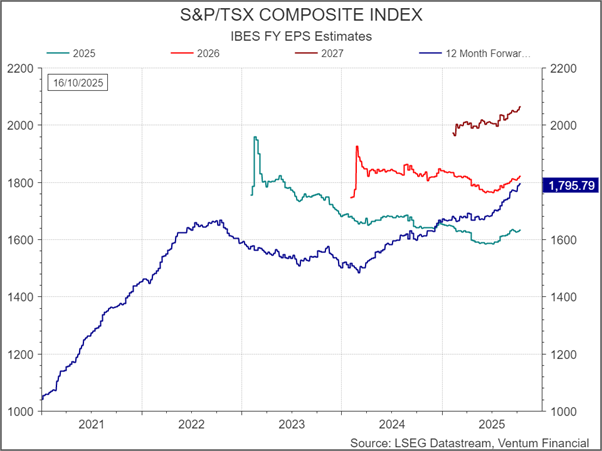

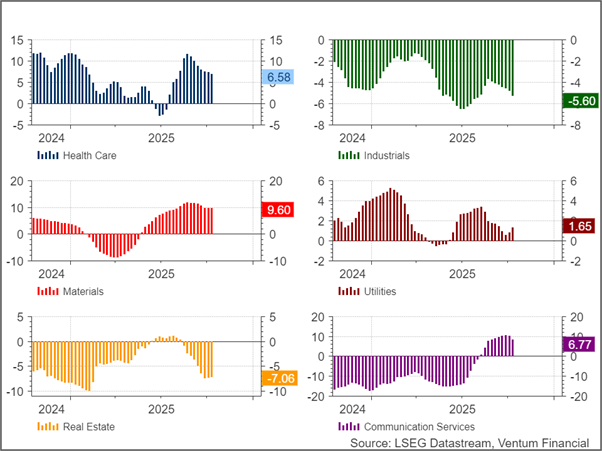

That improvement is also reflected in revenue expectations. Analyst sentiment toward Canadian corporate revenues has improved meaningfully since mid-summer, with net upward revisions (the number of upgrades minus downgrades divided by total number of estimates) turning positive across most sectors. As of October, eight of eleven S&P/TSX sectors show net upward revisions on a three-month moving average basis — mirroring the recovery in earnings expectations seen since August, when the U.S. extended its tariff détente with China.

Gains are most pronounced in Consumer Discretionary (+13.9), Information Technology (+13.4), and Financials (+10.1), reflecting resilience in domestic demand, digital investment, and capital markets activity. Materials (+9.6) have also seen solid improvement, aided by firm commodity prices.

Conversely, Energy (-4.7) and Industrials (-5.6) continue to face downward revisions, as export uncertainty and cost pressures weigh on revenue forecasts. Real Estate (-7.1) remains the weakest sector, pressured by elevated financing costs and soft commercial leasing demand.

At the aggregate level, S&P/TSX net revenue revisions have risen to +3.7, indicating a broad but uneven recovery in analyst expectations — consistent with improving corporate confidence despite the broader drag from trade tensions and a softening labour market.

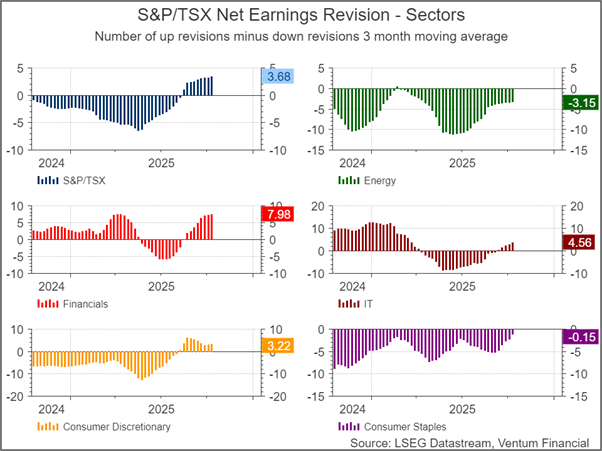

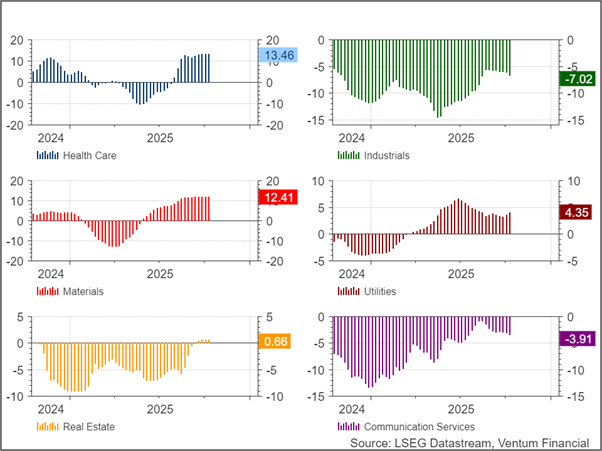

Earnings revisions across the S&P/TSX have turned decisively positive heading into Q4, reinforcing the improving sentiment seen in revenue expectations. On a three-month moving average basis, net upward revisions now stand at +3.7, marking the strongest breadth of upgrades since early 2022.

The improvement is led by Health Care (+13.5), Materials (+12.4), and Financials (+8.0), all benefiting from firm commodity prices, stabilizing credit conditions, and resilient domestic demand. Information Technology (+4.6) and Utilities (+4.4) have also moved higher, supported by steady investment and defensive positioning.

By contrast, Industrials (-7.0), Energy (-3.1), and Communication Services (-3.9) continue to face downward revisions, reflecting export uncertainty and softer capital spending. Real Estate (+0.7) has shown tentative stabilization after a prolonged downturn.

Overall, the earnings revision trend mirrors the recovery in forward EPS estimates and aligns with the broader market rally — suggesting that analyst confidence is rebuilding even as trade frictions and weak employment continue to weigh on the macro backdrop.

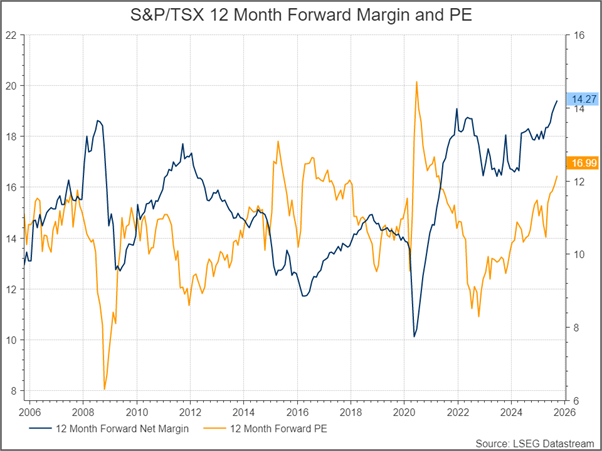

Margins Near Cycle Highs, Valuations Rebound with Earnings Recovery

The S&P/TSX 12-month forward net margin has climbed to 14.3%, approaching the highest levels since 2021, reflecting improved profitability and cost discipline across sectors despite trade uncertainty. At the same time, the 12-month forward P/E ratio has risen to 17.0x, recovering from last year’s trough as investor sentiment strengthens alongside the rebound in earnings revisions.

Historically, margin and valuation expansions have rarely moved in tandem for extended periods, suggesting the current phase reflects both cyclical optimism and renewed confidence in earnings durability. However, with margins near prior peaks and the economy still facing external headwinds, further upside may depend on sustained demand resilience and clarity on trade policy.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies.

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 – 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.