Valuations at the Edge: What Record CAPE Levels Signal for the Next Decade

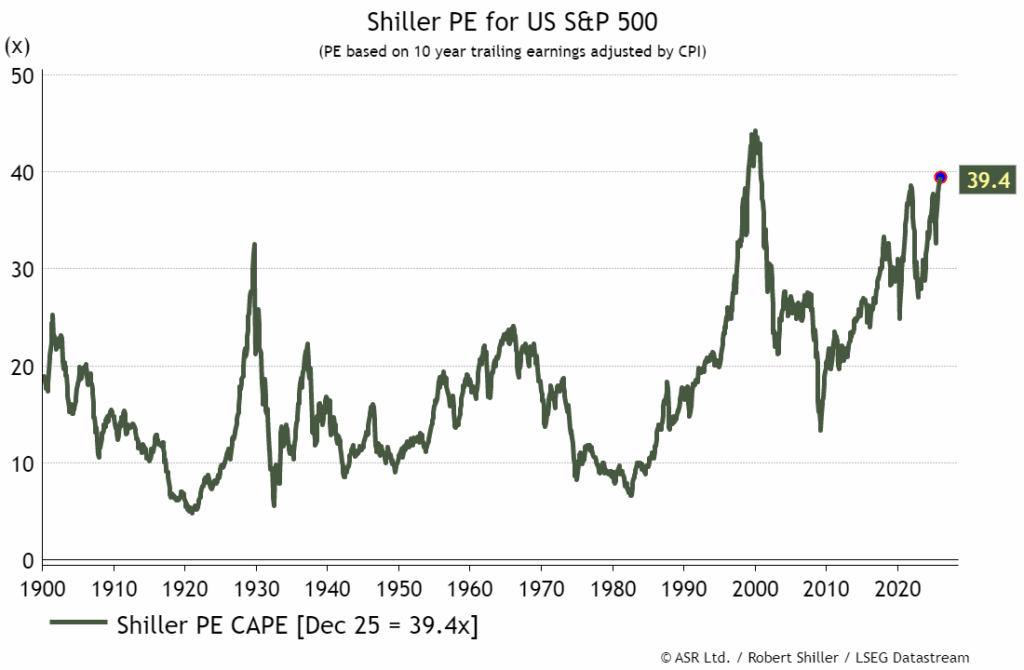

The Shiller CAPE ratio has climbed back toward levels rarely seen in more than a century of market history, prompting renewed debate about what such extreme valuations imply for the decade ahead. With the CAPE now hovering near 39—essentially tied with readings last observed during the late-1990s tech bubble—investors are once again confronting a market landscape where long-term return expectations become meaningfully compressed.

The Shiller CAPE, or cyclically adjusted price-to-earnings ratio, measures the price of the S&P 500 relative to ten years of inflation-adjusted earnings. By smoothing out business-cycle fluctuations, it offers a clearer sense of the market’s underlying earnings power and is widely used as a long-run valuation anchor. Unlike a standard P/E, which can be distorted by unusual cyclical swings in profitability, the CAPE focuses on structural earnings and tends to provide a more reliable signal of long-term valuation risk.

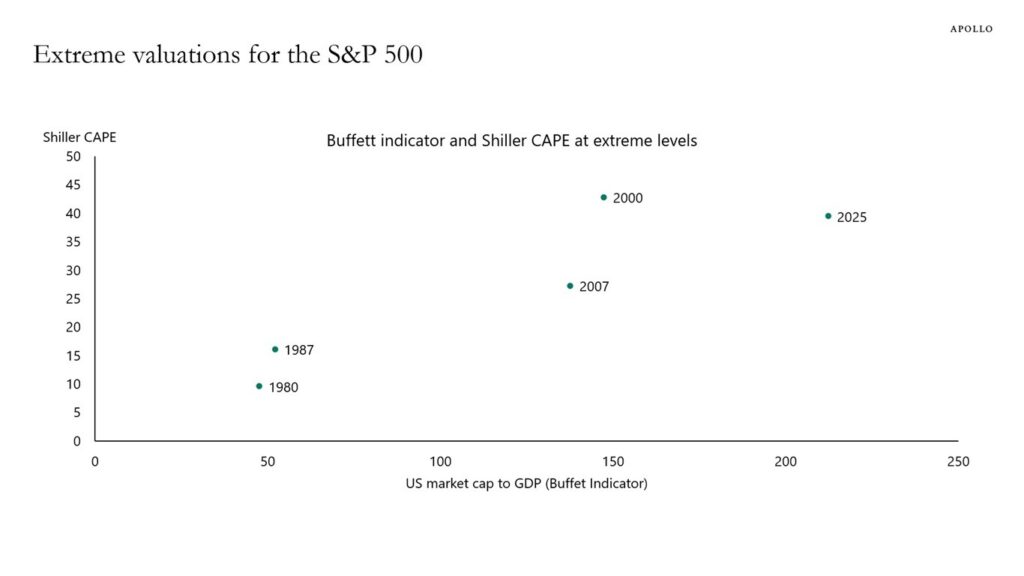

Today’s CAPE sits at an extreme level when viewed through more than 120 years of historical data, and it is not the only valuation metric flashing red. The Buffett indicator—US total market capitalization relative to GDP—is also hovering near record territory, rivaling the peaks of 2000 and standing well above levels reached in 2007. Together, these measures suggest that the market is priced for exceptionally strong future earnings and economic performance. Several forces have supported these elevated valuations: a powerful wave of optimism around AI-driven productivity gains, the dominance of mega-cap technology firms with extraordinarily high margins, and fiscal as well as monetary policies that continue to provide support. Strength in household and corporate balance sheets has further reduced perceived recession risk, while global capital flows continue to favour the United States over other major markets. These macro forces have combined to push valuation multiples to levels rarely sustained in prior cycles.

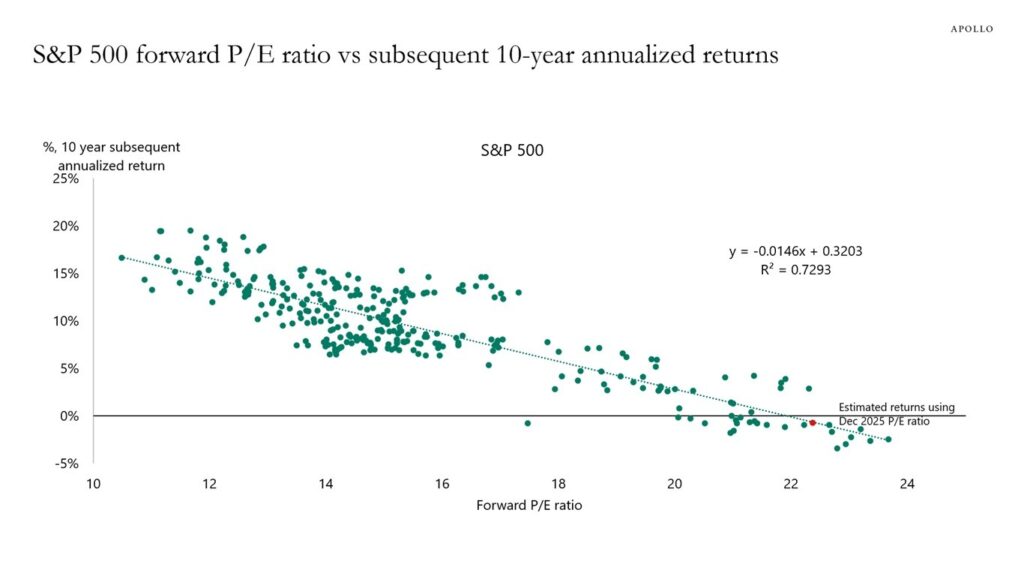

History shows, however, that starting valuations matter greatly for long-term returns. The relationship between the CAPE and subsequent ten-year S&P 500 performance is strongly negative: high CAPE readings have consistently been followed by below-average—and at times negligible—decade-ahead returns. Regression work, including analysis from Apollo, suggests that today’s valuation levels correspond to expected annualized returns in the low single digits, far beneath the market’s long-term trend. While the CAPE cannot predict short-term market direction, it remains one of the most reliable indicators of long-run equity performance, underscoring the challenges investors may face in the coming decade.

Source: Apollo Academy, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies.

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 – 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.