Virtually every major global equity market index reached multiple record highs during 2025. This remarkable—and for many investors, unexpected—strength in risk assets was driven by several powerful and overlapping forces. A surge in global spending on artificial intelligence, data centres, and the supporting infrastructure fueled earnings expectations and lifted equity prices to new highs. At the same time, a moderation in Trump-era tariff policies eased pressure on businesses and consumers, supporting global trade and confidence. Cooling inflation allowed central banks to pivot toward easier monetary policy, benefiting bank profitability, equity valuations, and housing activity. Finally, broad-based fiscal stimulus across major economies, including a significant increase in defence spending, provided a further tailwind for companies in Japan, Germany, and the United States.

As inflation pressures continued to fade, central banks in the U.S., Canada, Europe, Japan, and China shifted toward easier policy, while governments deployed targeted fiscal support to stabilize growth and enhance their defense. This coordinated response helped sustain risk appetite despite elevated geopolitical tensions, ongoing trade uncertainty, and a Ukrainian Russian war.

Asset class and sector performance was concentrated. Gold was the top-performing major asset in 2025, its best gain since 1979, rising roughly +64%, as investors and global government sought protection against geopolitical risk, currency volatility, and fragile global trade relationships. Canada was one of the strongest-performing equity markets, with the S&P/TSX Composite up about +31%, benefiting disproportionately from its heavy weighting in gold and resource-related equities.

U.S. equity gains were solid but remain highly concentrated by both company and sector. The S&P 500 advanced roughly +17%, while the tech heavy Nasdaq 100 rose about +20%, driven primarily by mega-cap technology companies. Over 40% of the S&P 500 gains this year, came from 7 companies! In 2024, the Mag 7 were well over 50% of the gain. This continues to be a concern for us.

In contrast, smaller companies lagged, with the Russell 2000 gaining around +15%, underscoring the continued dominance of large-cap balance sheet strength and AI-related investment themes.

Internationally, MSCI China and MSCI Emerging Markets each gained just over +30%, supported by a more favourable macro backdrop. In China, gains were driven largely by the technology sector, providing a lift to an economy still grappling with weak consumer spending, excess housing supply and ongoing financial risks.

The U.S. Economy in 2025

In 2025, the United States continued to stand out among developed economies. The US Federal Reserve estimates U.S. real GDP growth of 1.7%, the strongest performance in the developed world. Fiscal policy remained an important support, with the passage of the so-called “Big Beautiful Bill” expected to deliver up to US$5 trillion in cumulative fiscal stimulus over the next decade. On the monetary front, the Federal Reserve cut its policy rate by 75 basis points, responding to increasing concerns that the labour market was losing momentum.

A key source of uncertainty during the year was President Donald Trump’s renewed tariff threats, announced shortly after taking office. Ultimately, the scope and severity of the measures proved less disruptive than initially feared, reinforcing the market narrative captured by the “TACO” moniker—Trump Always Chickens Out. While inflation risks were initially viewed as skewed to the upside, outcomes were far more benign.

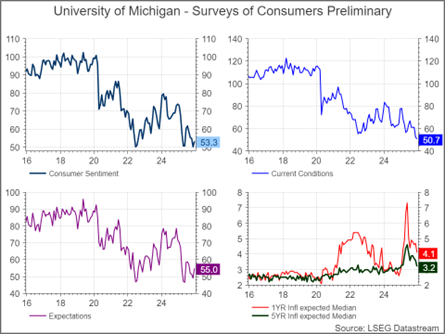

As of September, both headline and core CPI were running at 3.0% year over year—above the Fed’s 2% target, but well short of the feared tariff-driven inflation shock. Disinflation in energy prices and shelter costs, two large components of CPI and PCE, helped offset tariff pressures. Inflation expectations have since moderated, with University of Michigan survey data showing a marked pullback from the post-tariff announcement highs.

The labour market continued to cool through 2025. Non-farm payroll growth and job openings slowed steadily, though widespread layoffs failed to materialize. The unemployment rate rose modestly to 4.6% in November, from 4.4% in September, while the insured unemployment rate remained stable at 1.3%, little changed from early 2024. Both measures remain very low by historical standards. Despite softer hiring, nominal wage growth continued to outpace inflation and is growing at nearly 4% year-over-year. Consumer sentiment remained weak, weighed down by concerns over trade tensions and slowing jobs market, yet consumption proved resilient. Private investment was a notable bright spot, supported by strong spending on AI and data centre infrastructure, contributing roughly 0.5 percentage points to GDP growth based on GDPNow estimates.

The outlook for U.S. inflation remains a subject of debate. At the time of writing, the U.S. government has just emerged from its longest shutdown on record, leaving the latest available inflation data dated to September, despite being midway through December. The trajectory of inflation could still change materially, depending on whether additional tariffs are implemented—or rolled back. As a result, we continue to monitor inflation developments closely.

The Canadian Economy in 2025

In Canada, economic growth in 2025 was slower than in the United States but proved more resilient than many feared. The Bank of Canada estimates real GDP growth in the range of 1.2% to 1.4%, a modest pace that nonetheless avoided the worst-case outcome of a recession. Earlier in the year, policymakers warned that sweeping U.S. tariffs could push the Canadian economy into contraction. However, as of this writing, roughly 85% of Canadian exports to the United States remain tariff-free under USMCA rules, significantly limiting the economic fallout.

Household demand remained a key stabilizing force. Consumption held up well throughout the year, with retail sales rising 3.4% year over year as of September, broadly in line with the average pace seen over the past decade. Labour market conditions also improved modestly. The unemployment rate declined to 6.5%, down from a peak of 7.1%, supported by sustained hiring in the education and health care sectors. Structural labour shortages in these areas provided an important source of employment demand; a federal government report published in March 2025 estimated 78,600 unfilled health-care positions remained outstanding at the end of 2024.

Inflation pressures continued to ease. Headline CPI was running at 2.2% year over year, while core inflation stood at 2.9%. Although food prices remained elevated, declines in shelter and energy costs helped offset these pressures. Policy actions also played a role, as the Carney government rolled back several climate-related industrial taxes, providing modest relief to consumer prices. Against this backdrop of tariff uncertainty and relatively contained inflation, the Bank of Canada cut its policy rate by 100 basis points over the course of 2025. We believe policy interest rates are most likely to stay unchanged in 2026.

The IMF forecasts a meaningful rebound in Canadian growth in 2026, with real GDP expected to rise from approximately 1.15% in 2025 to 1.54%, driven by increased top-down investment from the federal government. Spending is expected to be concentrated in strategic areas such as defence, energy and natural resources, and infrastructure, providing support to both investment and employment.

However, a significant overhang remains. The United States is set to reopen negotiations on the USMCA with Canada and Mexico in the coming year, which is likely to be a source of market and policy uncertainty. Trade negotiations could introduce periods of heightened volatility, particularly for export-oriented sectors, which we will continue to monitor closely.

Sector Performance – S&P 500

U.S. equity returns in 2025 were led by sectors most closely tied to the ongoing AI investment cycle. Technology and Communication Services delivered the strongest performance, with Communication Services up approximately 34% and Technology rising about 24%. These gains were supported by continued momentum in AI-related spending, including demand for cloud infrastructure, semiconductors, data centres, and AI-enabled digital platforms.

Performance across the rest of the market was more moderate. Utilities gained roughly 19%, benefiting from lower interest rates and growing relevance to data centre power demand. Industrials returned about 16%, in line with the broader market, supported by demand in aerospace firms and growing relevance to power demand. Consumer Discretionary, Consumer Staples, and Real Estate underperformed.

Sector Performance – S&P/TSX Composite

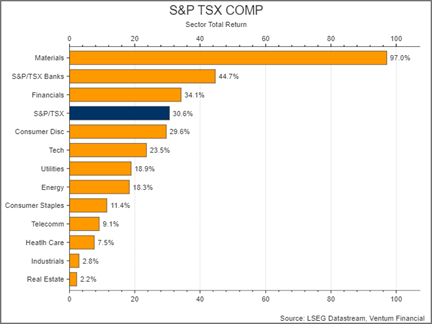

Canadian equity performance in 2025 was led decisively by the S&P TSX Materials sector, which delivered a total return of approximately +97%, far outperforming all other sectors. This exceptional result reflects the sector’s heavy exposure to gold producers, which benefited from strong investor demand for inflation and geopolitical hedges amid elevated global uncertainty.

The Financials sector also posted a strong year, returning about +34%, supported by solid performances from banks, capital markets, and wealth management businesses. Higher net interest margins provided a meaningful earnings tailwind, while capital markets activity and asset management revenues improved alongside stronger equity markets. Although loan loss provisions increased as economic growth slowed, much of this deterioration was already priced in during the first half of 2025, limiting negative surprises. At the lower end of the spectrum, Industrials +3% and Real Estate +2% lagged, constrained by slower growth and interest rate sensitivity.

Investment Strategy and Outlook for 2026

We expect U.S. economic growth to remain resilient over the next 12 months, with real GDP expanding at just over 2%, supported by still-accommodative fiscal and monetary conditions. Consumption should continue to provide a stable foundation for growth. Higher-income households remain willing and able to spend, even as lower-income consumers show signs of strain. The ongoing wealth effect, combined with solid real wage growth, continues to underpin household demand and supports our constructive outlook.

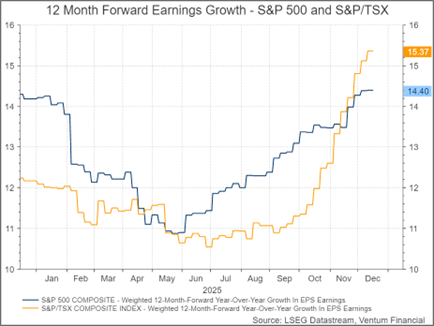

Earning momentum remains an important key pillar to our positive US equity outlook. Twelve-month forward EPS growth for the S&P 500 is now projected at +14.39%, a notable upward revision relative to expectations at the start of 2025.

We caution that valuation levels for many of the best performing sectors are at or near all time highs. Further, global indices are highly concentrated in limited number or companies or themes. Thus, any negative change to the AI narrative, inflation, long bond yields, US jobs market, defense spending could cause a material pullback. We recommend a more balanced equity and sector weighting.

While index-level valuations have reached their highest levels since the dot-com era, this risk is highly concentrated. Excluding the largest 50 companies, the remaining 450 constituents are trading at valuation multiples much closer to their mid- and small-cap peers and more in line with long-term historical averages. Valuations are elevated overall, but we believe the most extreme risks are concentrated in the largest U.S. companies.

We continue to favor Information Technology, Materials, and Financials, but advise that these sectors have done remarkably well leaving little room for disappointment.

Information Technology and Materials offer the strongest earnings growth outlooks, with 12-month forward EPS growth of 26.3% and 20.2%, respectively. Within Materials, forward earnings estimates for subsectors such as copper and steel have been revised sharply higher and are projected to grow by more than 40% year over year by the end of 2026.

In Canada, we hold a broadly similar view to that of the United States, although the outlook is more sensitive to trade-related developments. Unlike Japan, South Korea, and several other countries that have already concluded trade agreements with the United States, Canada has yet to secure a concrete arrangement. In addition, the upcoming USMCA renegotiations represent a further source of uncertainty that could cloud the near-term outlook.

Offsetting these risks, the current federal government has demonstrated a greater willingness to deploy fiscal stimulus through government-led investment to support growth. Public support for infrastructure development also appears to be strengthening. A recent Ipsos poll found that more than 75% of Canadians support the construction of new pipelines to British Columbia or Eastern Canadian ports.

We remain underweight on the TSX Energy sector given the continued downward trend in energy prices, now at their lowest in 5 years, and rising global inventories. A Ukrainian Russian ceasefire would pressure prices even further. We see potential opportunities in sectors positioned to benefit from rising infrastructure investment and growing export capacity. Select beneficiaries of increased demand and improved logistics could be well positioned to deliver attractive returns as policy clarity improves.

Long term interest rates may move higher 2026. After lowering their policy rates by 100 bps in 2025, the Bank of Canada signalled rates are now ‘about the right level’. While we are not expecting the BOC or US Fed to cut their short term benchmark rates much more than 25 bps in 2026, we could see mid to long-term interest rates, which have been rising not falling in the past couple of months, continue to tick higher as a result of rising economic growth in both US and Canada, robust wage and services inflation, and rising government stimulus, debt and deficits.

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 – 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.