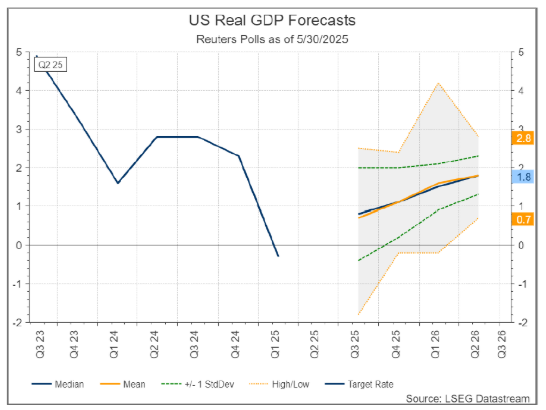

The second quarter of 2025 has been marked by heightened volatility and growing uncertainty across financial markets. Much of the disruption stems from renewed trade tensions following President Donald Trump’s announcement on April 2nd of sweeping tariffs on imports from 100 countries. The overarching concern is that these tariffs could simultaneously stall growth and accelerate inflation (stagflation) —a problematic combination for the U.S. economy . The initial data has already shown signs of stress: first-quarter GDP contracted by -0.2%, with the primary drag coming from a surge in imports as businesses sought to front-run the tariff implementation.

Consumer spending growth, a critical pillar of the U.S. economy, decelerated sharply falling to just 0.8% in Q1 from 2.7% in the previous quarter. Consumer confidence took a significant hit in April, dropping to 85.7, its lowest point since the depths of the COVID-19 pandemic in April 2020. However, sentiment rebounded to 98 later in the month as Trump scaled back some of the tariff measures and signed new trade agreements with the UK, while also advancing talks with India and China.

On the employment front, the picture remains mixed. The unemployment rate held steady at 4.2% in April, and retail sales data—still robust with over 5% year-over-year growth for March and April—points to underlying strength. But beneath the surface, a growing divergence is emerging: earnings calls from major retailers like Walmart and American Express highlight a growing strain on lower-income households, while higher-income consumers continue to spend freely. Labor market indicators also point to potential softening ahead, with job openings as a percentage of the labor force dipping to 4.3%, just below the 10-year average of 4.5%. At the same time, layoffs remain at pandemic-era lows, suggesting continued tightness in some areas.

Private investment has been a bright spot, contributing 1.34 percentage points to Q1 GDP—the highest since Q2 2023—fueled by robust capital spending in AI and electrification. However, forward-looking indicators from the ISM employment indices in both manufacturing and services have remained below 50 throughout 2025, signaling contraction. Services continue to outperform manufacturing, staying in expansion since mid-2024, but inflationary pressures persist across both sectors. Indeed, inflation expectations are now at their highest levels since the COVID period, both in consumer sentiment surveys and corporate commentary, despite falling energy prices helping to ease headline CPI to 2.3% and PCE to 2.2%, down from January’s highs of 3.0% and 2.5%, respectively.

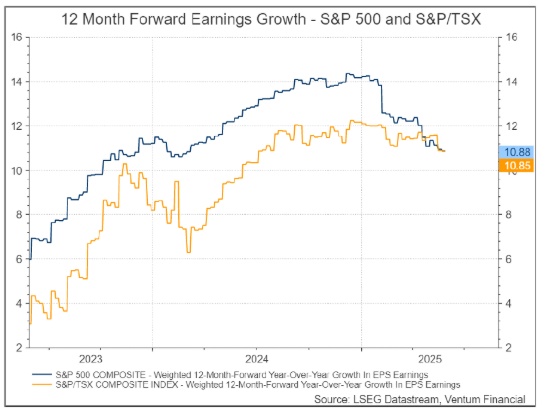

Despite economic headwinds and policy uncertainty, corporate America delivered better than expected Q1 earnings. By the end of May, 97% of S&P 500 companies reported their first-quarter results, with 76% exceeding consensus estimates. Sector-level performance varied significantly: Health Care (93%), Information Technology (83%), and Communication Services (83%) posted the highest beat rates. In contrast, Utilities, Consumer Discretionary, and Consumer Staples lagged, with 32%, 29%, and 28% of companies in those sectors respectively missing estimates, respectively. This dispersion reflects a shifting consumer landscape and sector-specific pressures, especially in rate-sensitive and lower-margin industries.

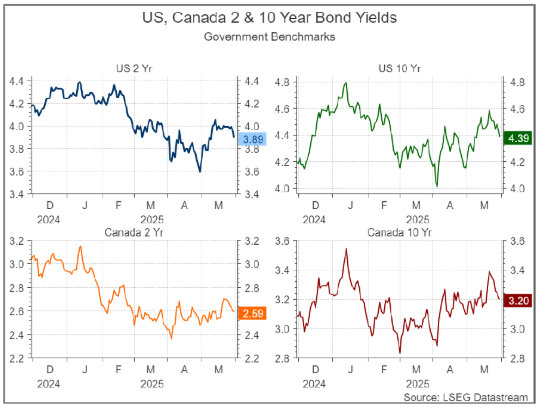

Although interest rates have been generally trending lower, bond yields have spiked since April due to concerns of tariff induced inflation, expanding fiscal deficits, rising credit risks, and growing odds of stagflation. Persistent core inflation remains a sticking point, complicating the Federal Reserve’s path forward. While market participants still anticipate two to three rate cuts by year-end, the Fed has made clear it will remain data-dependent and cautious. The ongoing inflation pressures—coupled with geopolitical risks and an uneven domestic recovery—mean the timing and extent of any US monetary easing remain highly uncertain.

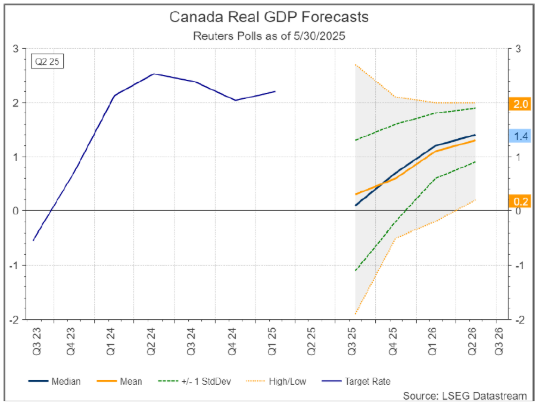

Canada’s economy delivered an upside surprise in the first quarter, with GDP growing at an annualized pace of 2.2%, exceeding consensus expectations of 1.8%. The main drivers behind this stronger-than-expected performance were a surge in exports to the United States and a buildup in inventories, as companies moved to front-run anticipated U.S. tariff measures. However, beneath the headline figure, underlying domestic demand showed signs of cooling. Consumer spending contributed just 0.17 percentage points to GDP growth in Q1, down sharply from 0.68% in the final quarter of 2024.

The labor market, too, is beginning to show strain. The unemployment rate has ticked up to 6.9%—matching its November 2024 high and reversing the earlier gains seen at the start of the year. Confidence indicators also reflect a more cautious tone. The Canadian Federation of Independent Business (CFIB)’s 12-month business barometer plummeted to an all-time low of 25.48 in March, though it rebounded modestly to 40 in April—still only matching the depths reached during the 2009 financial crisis. These soft data indicators underscore growing unease among consumers and small businesses alike.

On the inflation front, headline CPI fell to 1.7% in April, dropping below the Bank of Canada’s 2% target. This decline was driven by falling energy prices and the government’s removal of carbon taxes on select consumer goods. However, core inflation—which excludes volatile components—rose modestly to 2.5% from 2.2% in March, largely due to higher prices in core services. While labour market slack is increasing, wage growth remains firm, with average wages rising 4.3% year-over-year—hovering near decade-high levels and suggesting persistent underlying inflationary pressure.

In contrast to the robust earnings season in the U.S., Canadian corporate results have been more measured and reflective of underlying economic caution. As of this writing, 89% of companies on the TSX Composite have reported Q1 results, with 53% surpassing consensus expectations on their preferred earnings metrics. Sector-level performance was varied. Communication Services (80%), Consumer Discretionary (78%), and Utilities (77%) delivered the highest beat rates. Conversely, Health Care lagged significantly, with 67% of companies missing estimates, followed by weaker-than-expected results in the Energy (53%) and Information Technology (50%) sectors. The dispersion in earnings performance highlights the uneven impact of higher interest rates, slowing demand, and commodity price volatility.

Against this backdrop, the Bank of Canada has shifted to a more accommodative stance. With economic growth moderating and headline inflation trending below target, the central bank cut its key policy rate by 25 basis points over the past three months—the first move in what many expect could be a gradual easing cycle. The decision stands in contrast to the U.S. Federal Reserve, which has held its benchmark rate steady due to a solid US jobs market, solid capex spending and consumption coupled with concerns over trade policies and sticky core inflation.

Ottawa’s decision earlier this year to forgo a 2025 federal budget has fueled speculation around record-high debt issuance, adding upward pressure on short-term yields. The cross-border 2-year yield spread has widened to approximately 1.4%, reflecting diverging monetary policy paths between Canada and the U.S.

As Q2 progresses, the Bank of Canada faces a delicate balancing act: managing inflation risks while supporting a slowing economy. With policy uncertainty still high and external headwinds from trade frictions and global volatility lingering, both fiscal and monetary authorities will need to tread carefully to maintain credibility and stability.

Equity markets recover almost all Feb-April selloff

Global equity markets experienced a sharp sell off from February to April 2025 due in large part to the sweeping set of US imposed import tariffs. On April 2, President Trump sent markets reeling after introducing import tariffs on over 100 countries with especially high tariffs against China. Equity markets recorded their worst loses since March 2020. From February to April, peak to trough, the S&P 500 plunging almost -20% and the TSX Composite -13%.

The markets then staged a dramatic recovery after US President Trump’s softened his trade stance including a 90-day pause and reduced tariff rate on China imports. After several trade policy retreats, investors now believe President Trump will back down when pushed and that the worst-case scenario has been averted. Also, and importantly, markets have moved higher due to the solid economic data (jobs and spending), better than expected Q1 corporate earnings and continued strong AI spending by mega cap tech companies.

Markets delivered strong gains in May, with the S&P/TSX Composite Index up +5.8% and the S&P 500 up +5.7% month-to-date. In Canada, leadership came from Consumer Discretionary (+9.4%), Industrials (+9.0%), and Information Technology (+7.8%), while Health Care (-1.8%), Communication Services (+0.6%), and Utilities (+1.1%) lagged. In the U.S., Technology (+10.6%), Consumer Discretionary (+9.8%), and Communication Services (+9.5%) led gains, while Health Care (-6.6%), Real Estate (-0.2%), and Consumer Staples (+0.2%) underperformed.

We expect the near- to medium-term to remain shaped by US trade policy and economic uncertainty. We are more cautious in the near term, as prices have come back a long way and seem to be pricing in little economic risk from US trade policies, slowing economic growth, rising long term interest rates, and a softening jobs market.

On a positive note, the global AI spending boom continues unabated with positive implications for US mega cap technology. We are staying with a higher cash balance and would overweight more defensive companies that can hedge tariff risks (services over goods, strong margins/pricing power, reasonable valuations), along with key AI benefactors (hyperscalers, data centers, chips, and select utilities).

Disclaimers

Ventum Financial Corp.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Ventum Financial Corp. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any par.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Ventum Financial Corp. warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Ventum Financial Corp. or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.