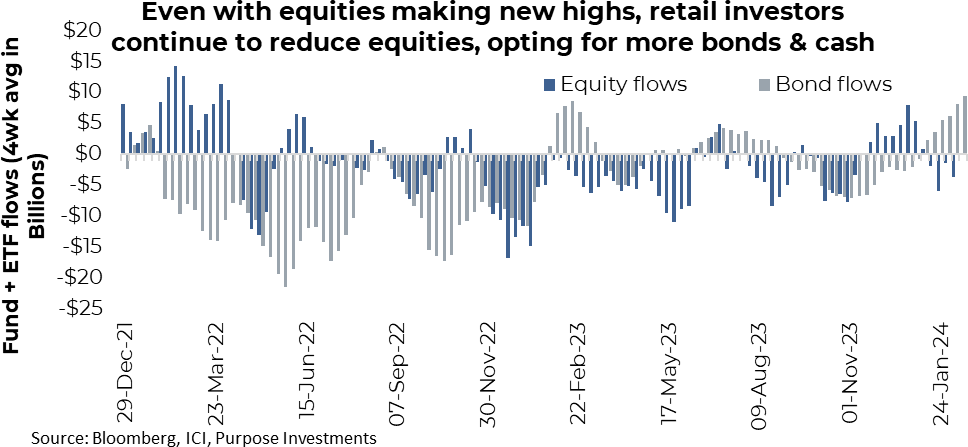

So far this year, investors have piled into cash, added into bonds and sucked money out of equities. Apologies, we are going to use U.S. listed data here for convenience and because larger numbers are more fun. Based on ICI data, investors have sucked $25B out of equities, added $122 billion to cash and added $52 billion to bonds. The chart below is the rolling 4-week average flows into bonds and equities. Equities have remained sporadic over the past few years, with brief periods of inflows and outflows. In 2023, a solid year in the market, equity outflows were $133 billion, so the trend in 2024 remains much the same. Bonds, which experienced HUGE outflows in 2022 as yields rose, have been seeing more inflows of late.

While equity flows have been negative on aggregate, it does appear it is largely broad-based U.S. exposure that is being reduced. International is up a little, and if ETF flows are any indication, technology is attracting some flows. But we are going to pivot to cash and bonds. It shouldn’t be too surprising that the inflows to cash and bonds, with the most attractive yields in many years, are a strong lure.

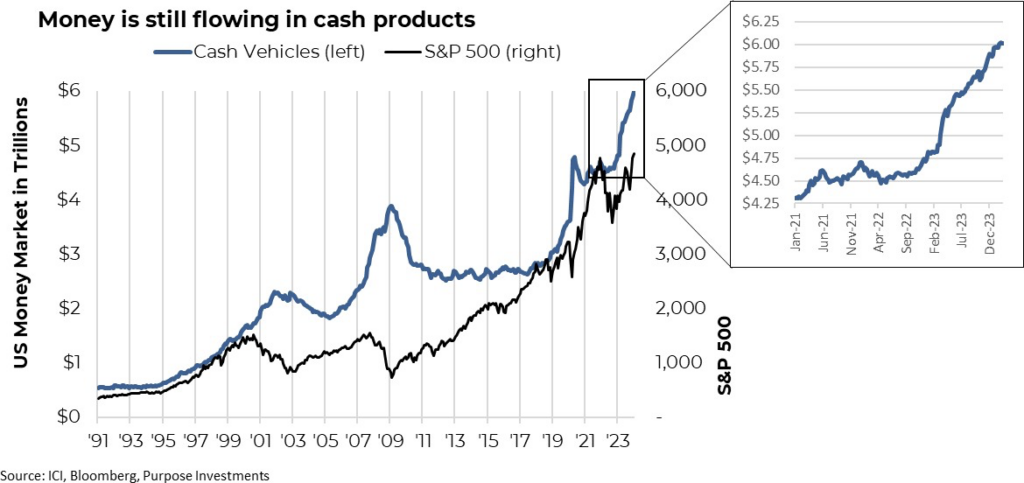

The flows into cash vehicles have been incredible. Even more incredible is that cash inflows have historically coincided with periods of market weakness (see 2001, 2008, and 2020 in the chart below). Yet these current inflows are more about capital being attracted by a decent yield as opposed to capital fleeing equity markets and looking for a place to hide. More of a pull compared to a push. It is also important to differentiate where the dollars are coming from. If simply moving from a bank account that pays very little to a higher yield vehicle, it is possible that money will never move into more risk assets such as stocks or bonds. But some will, and that is one pile of cash sitting there.

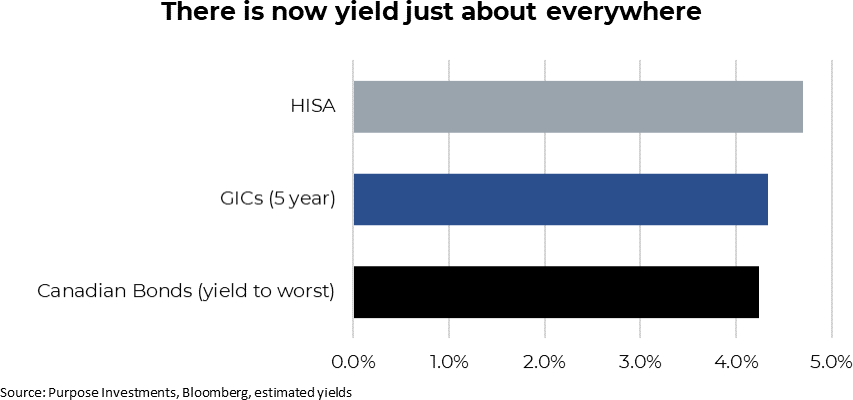

Higher yields everywhere, from cash to GICs, to bonds, and even to dividend-paying equities, have created perhaps one of the most recurring questions of the past year – which is best between cash, GICs and bonds? We will tackle the dividend equities in another instalment.

Cash, GICs or Bonds?

It is not a simple question as much depends on the purpose of the capital and what happens next in these markets. For simplicity, we are going to reference High-Interest Savings Accounts for cash, and we pulled a preferred GIC offering as our proxy for GICs. Naturally, these are just estimates or approximations.

The really interesting aspect today is how similar yields have become across the three options. HISAs, even after the changing legislations (an update on that HERE), are carrying a yield between 4.5 and 5%. GICs are a bit lower, at just above the 4% level. And Bonds, which do carry lower current yields in the 3-3.5%, have a baked-in gain given most are trading at a discount to par, which brings the yield to worst up to around 4.2%. So, really, they are all kind of clustered together, offering some decent yields.

Each of the three options do offer rather different characteristics that will behave differently depending on what markets and rates do in the coming quarters or years. The table below really tries to capture some of the more pertinent characteristics of each.

It really depends on what happens next. Here are three simplistic scenarios, with who wins or loses among HISA vs GICs vs Bonds.

#1 Inflation remains sticky

While not our base case expectation, what if inflation remains sticky or even accelerates? We have just seen

U.S. CPI tick higher over the past few months. In this case, central banks are unlikely to start cutting rates anytime soon and could even raise rates. This would also likely translate into bond yields moving higher.

- HISA wins as yields remain high, and any potential rate hikes would result in more yield with a stable value.

- GICs do ok, given the high rate is locked in and while they would not capture any rate hikes the quoted price of the GIC would remain stable even if yields rose.

- Bonds lose as higher inflation and yields result in lower bond prices.

#2 Goldilocks

Inflation continues its path down, allowing bank rates to come down a little. However, with a still resilient

economy, central banks won’t be overly aggressive in cutting rates. All three options do ok under this scenario.

- GICs win, given the coupon rate is locked in at what is now a higher level than the overall market.

- HISAs do ok. The bank rate cuts result in a lower yield, but since there are only a few, the yield remains healthy.

- Bonds do ok. Lower inflation and bank rates likely translate into bond yields coming down a bit, adding some capital appreciation to the current yield.

#3 Slow growth or recession

Inflation fades as the global economy continues to decelerate; this results in more aggressive central bank rate cuts. The recession also leads to a material fall in bond yields.

- Bonds win as lower yields lead to healthy capital appreciation. There could be some credit risk, though, depending on the type of bonds held.

- GICs do ok, enjoying the locked in yield. But in this case, the stable pricing of GICs is a weakness as their price would rise given lower bond yields.

- HISA lags as the current yield comes down as central banks cut rates more aggressively.

These are very simple scenarios but clearly demonstrate some of the pros and cons of each option. Yet there are some even more important considerations. If the capital is just looking for a higher rate from, say, a chequing account, just lock in with GICs or go variable with a HISA. However, if the capital is part of an

overall portfolio, it’s a bit more complicated.

Bonds tend to do well when themarketgoesrisk-off (akaequitieslower)– This is the reflexive nature of bonds & equities. While it doesn’t always work, like in 2022, it does work most of the time. Bonds provide a ballast for the portfolio and often will move in the opposite direction, especially when equities are falling. HISA and GICs offer price stability but not this reflexive behaviour.

Optionality – What if equities fall 20 or 30%? The ability to rebalance during more volatile periods in the market is a very important process that adds value over time. If too much capital is locked in, this reduces the ability to rebalance. Bonds and HISAs offer optionality.

Final Thoughts

There is no right or wrong answer to the original question; in fact, much depends on the purpose of the capital and what happens next in the market. And while that may complicate the process, at least today, there are many choices and options to find yield. A few years ago the demand for cash, GICs and even bonds was far less than today. It’s nice to have choices.

— Craig Basinger is the Chief Market Strategist at Purpose Investments