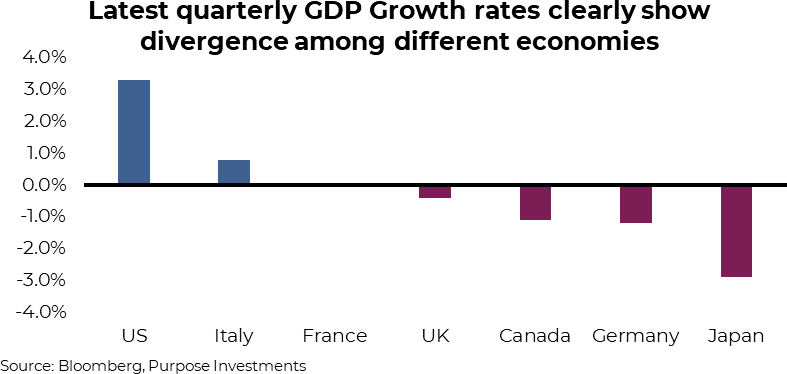

Over the past month or so, the economic data from America has certainly turned up somewhat. A strong Q4 GDP print of 3.1%, two back-to-back months of 300k+ job gains, and even manufacturing activity has ticked higher. So, where is this recession that has been the talk of the town for the past year or even longer? It appears to be almost everywhere else. Maybe not outright recession, but certainly weakness. The latest GDP readings are negative in the UK, Canada, Germany and Japan, leaving only two of the G7 members with positive economic growth.

Much of this divergence can be explained by two factors: economic sensitivity to interest rates and global trade. Countries that are more sensitive to rates and global trade are doing worse; those less exposed are doing better.

As we all know, rates/yields have moved substantially higher over the past couple of years, yet that impacts different parts of the economy differently. Based on different economic compositions from one country to the next, rate changes can hurt more or less. The U.S., for instance, is less sensitive to rates given the structure of their mortgage market. Dominated by 30-year fixed mortgages, changes in rates don’t

impact consumers’ mortgage payments as much. It is estimated the U.S. has less

than 10% of mortgages set to variable rates, compared to 30% in Canada. Furthermore, fixed mortgages in Canada max out at 5 years, meaning the resetting of higher payments is increasingly being felt as mortgages are renewed.

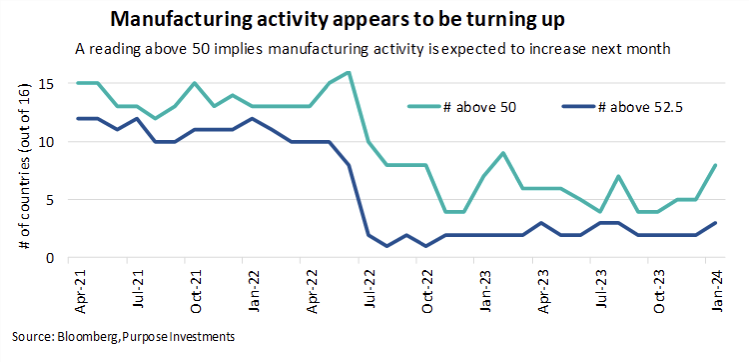

While encouraged, our view on manufacturing is tempered. Manufacturing activity exploded during the pandemic as we all wanted more goods. As the pandemic diminished, consumers returned to more normal spending patterns. So, that spike in 2021/22 was followed by a dearth in 2023. Global spending growth does appear to be slowing, likely a result of higher rates.

Wait for it, but we could be getting close to a period when good economic news stops being suitable for markets. This incredible run over the past three months has seen the S&P 500 rise 14 of the past 15 weeks – a feat not repeated since the early 1970s. The initial rise was from an oversold market that started celebrating more evidence that inflation was coming down, opening the door for rate cuts this year. This traversed from inflation optimism to optimism about U.S. economic strength. Unfortunately, strong economic growth does not give with rate cuts nor with inflation making a speedy decline down to the magic 2% realm.

Final Thoughts

The U.S. is the biggest economy in the world, and its equity market now carries about a 70% weight in the MSCI World Index. Yes, if you buy a passive cap-weighted global equity ETF, it’s really just the S&P 500 plus some odds and sods. The U.S. economy could certainly remain immune to slowing growth elsewhere. Maybe the stock market can keep climbing with earnings growth slowing. However, the biggest constant for both markets and economies is often reversion to the mean. And both are well above their means at the moment.

— Craig Basinger is the Chief Market Strategist at Purpose Investments