US Economic Growth Fueled by Resilient Consumers and AI Investment

The U.S. economy staged a strong rebound in Q2 after contracting in the first quarter. Real GDP grew at an annualized rate of 3.0%, supported by steady consumption and a still-resilient labor market. Looking ahead, Q3 growth is tracking at 2.3% according to the Atlanta Fed’s GDPNow model. Consumer spending expected to contribute more than 1.5 percentage points—roughly in line with its average contribution over the past two years. Household demand, along with AI related private investment, continue to be the key drivers of growth.

Labour Market – Showing Signs of Weakening

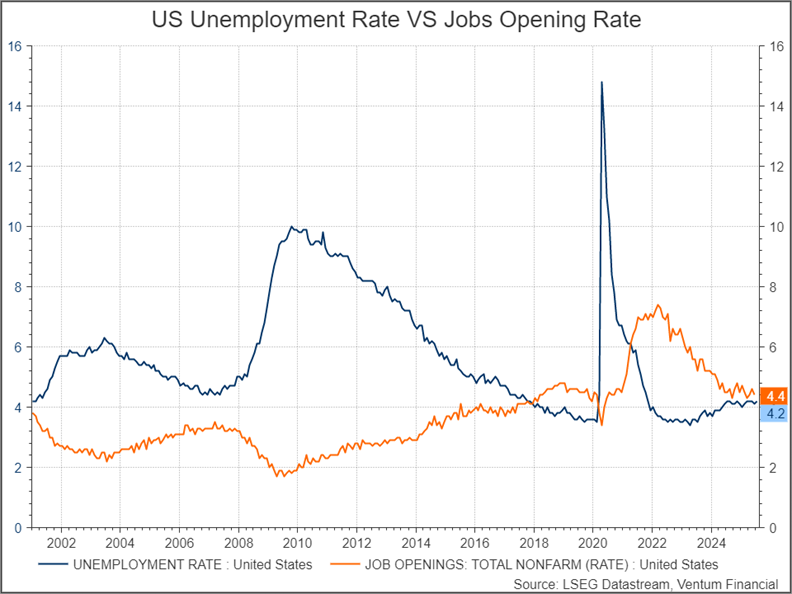

The US jobs market continues to show resilience; however, signs of softening are becoming more visible. July’s non-farm payroll report showed a substantial decline with a modest gain of just 73,000 jobs, while downward revisions to the prior two months erased 258,000 positions—fueling concerns of slowing momentum. President Trump quickly criticized the reliability of the BLS survey-based methodology, even going so far as to dismiss the agency’s chief. Adding to concerns, long-term unemployment has inched higher: one in four unemployed Americans has now been out of work for more than 27 weeks, a trend that is gradually worsening.

However, alternative labor measures paint a more constructive picture. Weekly unemployment claims remain historically low, with the insured unemployment rate—covering roughly 90% of the labor force—holding at just 1.3%, near all-time lows. Job openings, while well off their 2022 highs, have stabilized since mid-2024. Taken together, this suggests businesses are cautious about new hiring in an uncertain environment but are also reluctant to cut staff. Notably, the ratio of job openings to unemployed workers still points to a market with more demand for labor than supply.

Consumer Spending and Sentiment Positive but Manufacturing Weaker

Consumer spending has also proven resilient despite tariff-related distortions. In both Q1 and Q2, households accelerated big-ticket purchases—particularly autos—in anticipation of higher import costs. Stripping out volatile categories like motor vehicles and gasoline, core retail sales rose 0.5% month-over-month in the most recent print, broadly consistent with the 2024 average.

Consumer sentiment has improved meaningfully since Trump’s announcement of a tariff truce with China. The index, which rebounded to 98.4 from 85 in May, has since stabilized around that level, reflecting steady confidence even amid ongoing policy uncertainty. Business surveys present a mixed picture. The ISM manufacturing PMI slipped to 48 (less than 50 represents economic contraction), while the non-manufacturing index edged down to 50.1—both near their lowest levels since the start of the year. Notably, the “prices paid” components in both surveys continued to climb, underscoring that firms still anticipate upward pressure on inflation.

Investment Trends – Housing Weakness, Tech Powers Ahead

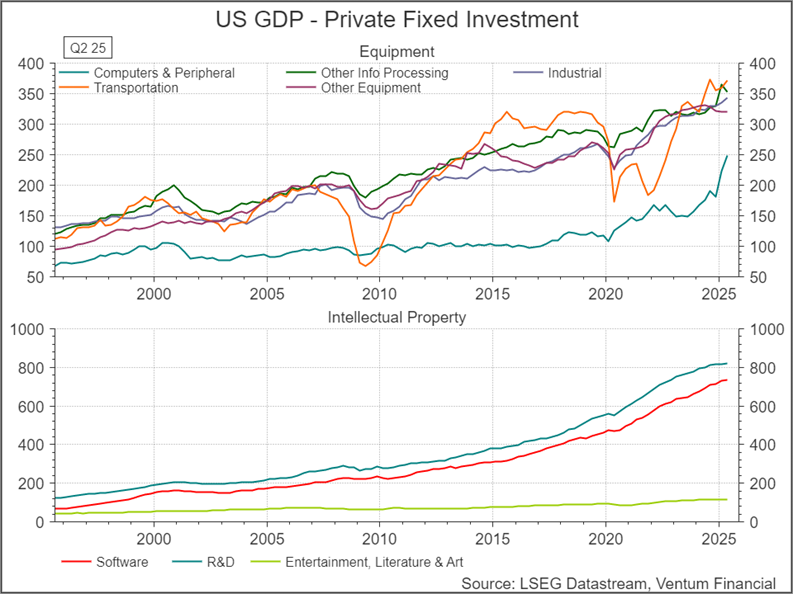

Private investment remains a two-speed story. Residential investment contracted again in Q2, as high mortgage rates continue to weigh on new development.

In contrast, non-residential investment surged, driven by capital expenditures in AI, aerospace, and digital infrastructure. Spending on R&D, software, and computer equipment reached record levels, with computer equipment investment posting the strongest quarterly increase. Importantly, businesses—particularly large firms and those tied to AI and electrification—do not view current interest rate levels as restrictive. This bifurcation underscores the drag from housing against the backdrop of an ongoing technology-driven capex boom.

Corporate America Delivers Another Strong Earnings Season

As of August 15th, 459 S&P 500 companies had reported Q2 results, with 80% surpassing consensus estimates. Sector-level performance was broadly strong, with the exception of Materials, where half of companies fell short. The standout sectors were Information Technology (94% beat rate), Communication Services (86%), and Health Care (88%).

Forward earnings expectations have also improved: 12-month EPS growth estimates have climbed back to 12.3%, regaining the levels seen in April before the “Liberation Day” tariff shock, though still below the 14%+ pace at the start of the year. The upcoming Q3 data will be critical, as inventories built up ahead of tariffs are expected to be depleted, revealing the true impact of inflationary pressures on margins and demand.

Inflation Outlook – Easing in Key Categories, Policy Path Complicated

Inflation data has trended upwards but has so far surprised to the downside relative to expectations. Headline US CPI is at 2.7% and core CPI at 3.1% YoY for the last print. Tariff-related pass-through effects are starting to appear in CPI, but key categories are providing relief. Importantly, energy prices continue to trend lower, easing headline inflation, while shelter inflation—the single largest CPI component, at roughly 30% of the basket—has decelerated to 3.7% year-over-year, down from 4.4% at the start of the year. The moderation in shelter costs offers some relief to consumers, though medical and transportation service prices remain areas to watch. The 3 segments, shelter, medical and transportation services accounts for roughly 60% of consumer spending. A weakening labor market, combined with the lingering effects of tariffs, has created a challenging backdrop for the Federal Reserve. Markets are increasingly looking past the Fed’s data-dependent messaging, already pricing in three rate cuts before year-end in anticipation of a more accommodative stance. Speaking at Jackson Hole, Powell acknowledged that policy remains in restrictive territory, adding that while tariffs may temporarily push prices higher, their inflationary impact should fade. With unemployment steady, the Fed can proceed carefully, but Powell’s remarks nonetheless opened the door to a potential cut at the September 16–17 meeting, putting heightened importance on upcoming employment and inflation reports.

Canada: Weaker Growth but Better than Feared

Canada’s economy remained soft in Q2 under the weight of the US trade war, a more cautious consumer and wary corporate sector, with GDP growth roughly flat. Still, the outcome was better than many feared. Thanks in part to that 85% of Canadian exports to the U.S. continue to move tariff-free under CUSMA provisions, providing a crucial buffer for exporters even as steel, aluminum, and autos remain pressured.

Labour Market Still Soft, Consumption Holds Up

The labor market cooled further, signaling a gradual slowdown. The unemployment rate has held at 6.9% since May, but broader measures reveal greater weakness. Involuntary part-time employment has climbed to nearly 1% of the labor force—higher than at any point in the past 20 years—pointing to weak jobs creation.

Household finances have shown signs of stabilization. Household debt as a share of disposable income fell to 171.1% in Q1 2025, down from a peak of 185% in 2022 and closer to levels last seen in 2016, just before the late-2010s housing boom. While elevated mortgage costs are likely to prevent households from taking on significant new debt, the moderation eases concern about excessive leverage.

Importantly, mortgage rates have declined sharply over the past two years, with uninsured five-year fixed terms now in the 4–4.5% range—well below their 2023 peak above 6%. Variable rates have dropped nearly three percentage points to around 4.5%, providing meaningful relief, particularly for highly leveraged landlords who bought at elevated COVID-era prices.

Combined with moderating housing costs, lower energy prices, and solid wage growth—still running at 3.5% year-over-year despite cooling from 2024 highs above 5.5%—households are seeing improved cash flow and a more sustainable debt burden. These dynamics have helped sustain consumer spending even as job creation slows. The latest retail sales data for June show an annual increase of 6.6%, marking the strongest pace of growth since August 2022.

Sentiment, while still subdued, has improved. The CFIB small business barometer climbed to 50.9 in July, a sharp rebound from 25 in May, though still shy of its long-term average near 60. On the investment front, Ottawa’s C$130 billion stimulus commitments are beginning to flow, supporting activity in aerospace, defense, and industrials. Housing investment remains subdued, as macroeconomic uncertainty continues to deter buyers despite the relief from lower mortgage rates.

Inflation Outlook: Room to Cut, No Urgency Yet

Inflation pressures moderated further. Headline CPI eased to 1.7% in August, below the Bank of Canada’s 2% target, though core inflation remained somewhat sticky. Housing costs—which account for 30% of the CPI basket—edged higher in August, but the broader trend continues downward. Energy’s decline, along with the removal of carbon taxes on select goods, contributed to the improvement.

The Bank of Canada kept rates steady since March, balancing muted inflation against a cooling labor market. The 2-year yield has trended sideways since then and is currently at 2.7%. With price pressures easing and employment weakening, policymakers have room to cut, though they see no urgency. The groundwork is being laid for a more accommodative path should conditions deteriorate. At present, the market is pricing in 1 cut by year end. Stronger-than-expected consumption and a more favorable tariff backdrop have pushed long-term growth expectations higher, lifting the 10-year Treasury yield to 3.5% from below 3% in March. As a result, the yield curve has steepened, reflecting reduced fears of an imminent recession and greater confidence in the medium-term outlook.

Equity Markets Surge on Rising Odds US Fed Will Cut Rates in September

At Jackson Hole, Fed Chair Jerome Powell signaled that interest rates may need to be cut as risks to the labor market rise, though he stressed the Fed would proceed carefully. He noted that while tariffs could temporarily push prices higher, their inflationary impact is likely to fade, leaving the door open to a possible September rate cut.

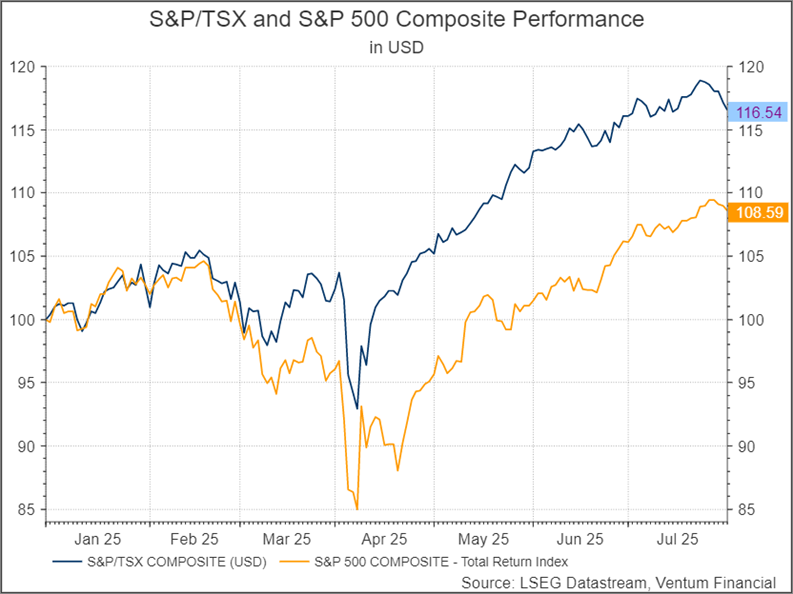

Canadian and U.S. equity markets have meanwhile shown remarkable resilience, recovering from the sharp declines of April 2025 and, following today’s speech by Fed Chair Powell, reaching new all-time highs.

The strong rebound in equities has been fueled by several factors, including: (1) tariffs proving less damaging than initially feared, with President Trump signaling a willingness to lower them if needed, (2) expansive fiscal stimulus across the U.S., Canada, and Europe—including the “Big Beautiful Bill” in the U.S., multiple Canadian packages, and sharply higher European defense and infrastructure spending, (3) a sharp recovery in corporate profit expectations from their April lows, (4) massive investment flows into AI-related industries.

From January 1 to July 31, 2025, the TSX Composite Index delivered a total return of 16.54%, nearly doubling the 8.59% total return of the S&P 500 (in USD terms). The strongest performing sectors in Canada were Materials (+30.13%), Consumer Discretionary (+16.28%), and Utilities (+12.71%). The weakest performing sectors were Health Care (-11.99%), Industrials (+5.44%) and Consumer Staples (+6.23%). We note that the small number of constituents in the Canadian Health Care sector can lead to heightened volatility, and the reported return may be more reflective of company-specific performance than broader sector trends. In the US the strongest sectors have been Industrials (+15.26%), Technology (+13.26%), and Communication Services (+13.17%). The weakest performing sectors in the US were Health Care (-5.38%), Consumer Discretionary (-1.72%), and Real Estate (+1.55%).

Portfolio Strategy and Outlook

Our near- to medium-term outlook for equities and other risk assets continues to be positive due to the factors mentioned above.

However, we remain highly focused on the weakening US jobs market, impact the tariffs will have on consumption and inflation and softer housing market. Persistent core inflation and producer price inflation remain a concern. Of course, Trump policy uncertainties are high.

Equity markets seem to have shrugged off the impact of tariffs and while we expect the bigger impact to be felt by the goods sector (a smaller part of the economy), we think it is too early to think tariffs don’t matter. Tariffs may take multiple quarters before they are felt by the consumer.

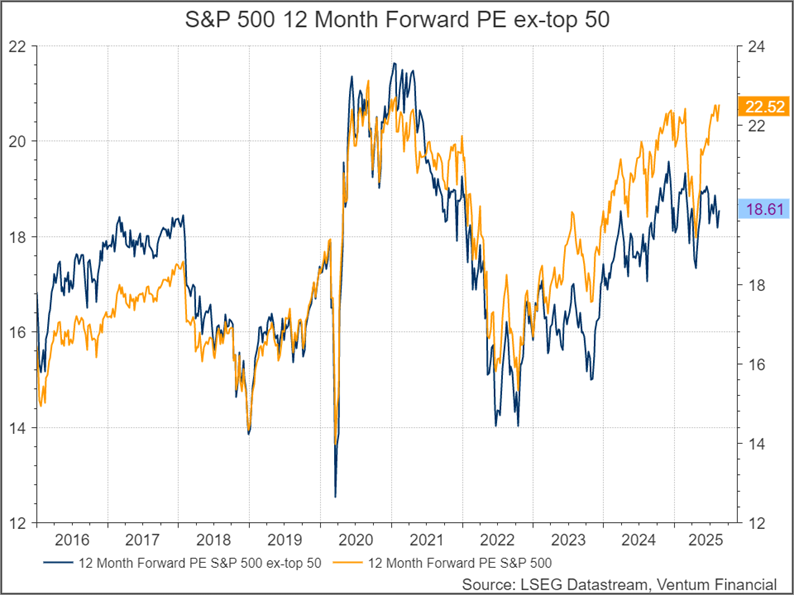

Also, valuations for the S&P 500 are hovering near historic highs, with the 12-month forward P/E at 22.5x. For context, the previous peak was 22.8x in August 2020, while the dot-com bubble reached 24.5x. Excluding the 50 largest companies in the index, however, valuations appear more grounded at 18.6—closer to levels seen in 2017–2018. The elevated multiples of the top 50 companies reflect heightened expectations for mega-caps and the ongoing AI trade.

We have grown more bullish since our last report, largely because of key factors such as better-than-expected earnings, lower and near-term interest rate cuts, moderating inflation and record high household net worth.

Governments worldwide have shown a willingness to provide greater stimulus in the face of slowing trade.

This should be positive for the industrial sectors e.g. defense and infrastructure.

As a result, we have moved to a more neutral cash weighting. We continue to favor high-quality growth companies with strong margins and lower volatility, along with key beneficiaries of the AI boom—such as semiconductor makers, hyperscalers, aerospace, industrials and select utilities. Given the high valuation levels, we expect volatility to remain high.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies.

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 – 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre – Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.